Traders,

Whilst I proceed to succeed in the best luck with the intra -day business in Move2Move and Momentum, which has lately taken into consideration my collection, I start to see the early indicators of a converting surroundings, which might once more give tribute to the sale of swings. So, I can come with a mix of intraday and swinging settings within the statement listing this week.

Beginning with a couple of swinging concepts.

(Nasdaq: amzn) Without reference to whether or not we get the next for a couple of concepts of swing, relies on the facility of the marketplace to care for its foundation after spectacular closure on Friday. AMZN is a good atmosphere R: R, because the stocks are consolidated above the initial resistance between its 50 and 5-day SMA. I’m in search of a step forward above its 5-day SMA for coming into, with a LOD prevent, geared toward transferring to resistance 1 and its 20-day SMA to hide part and monitor the remainder in opposition to the minimal of the day.

*Please notice that costs and different statistics in this web page are hypothetical and don’t mirror the affect, if any, positive marketplace components, reminiscent of liquidity, slipping and fee.

Sign in now to get our best possible weekly stocks and keep in entrance of the marketplace!

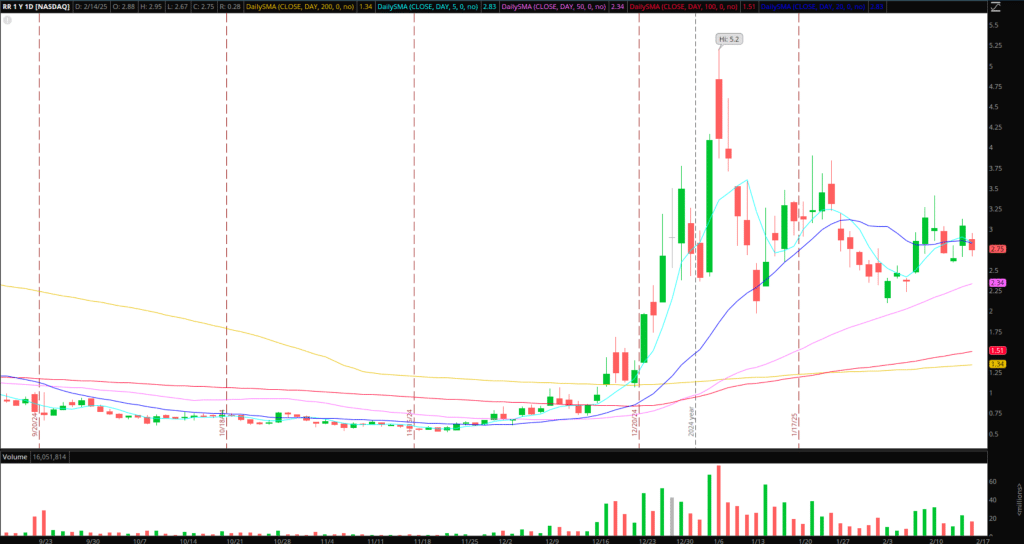

(Nasdaq: rr) An organization with robotics with a slight capitalization, which, in spite of the SERV cave in on Friday, has retained its bull formation in a better time frame that I love. Consequently, I can apply this someday. Something you want to learn about is possible dilution. I wish to see a forged step forward in the associated fee and quantity of greater than $ 3 to be excited and feature a place in opposition to the minimal of the day. Underneath $ 2.5. USA is now not actual and also you must no longer watch.

*Please notice that costs and different statistics in this web page are hypothetical and don’t mirror the affect, if any, positive marketplace components, reminiscent of liquidity, slipping and fee.

(Nasdaq: clutch) Profits are the top of the following week. Promotions have an excellent atmosphere for day-to-day and better phrases. He escaped from a vital base and found out enhance above the initial resistance. I love the overall view. That is on looking at two primary situations. At first, this can be a step forward, forward of the source of revenue of greater than $ 5 in line with quantity that I might was hoping for a very long time to sway with LOD prevent. I might absolutely pop out to profits. Secondly, this can be a step forward after profits, and on this case I used to be in search of a spoil, give and turn to the set up or retention of key enlarged clock ranges to start up a protracted blow after profits to proceed.

*Please notice that costs and different statistics in this web page are hypothetical and don’t mirror the affect, if any, positive marketplace components, reminiscent of liquidity, slipping and fee.

(NYSE: Snow) And (Nasdaq: rklb)Which gained source of revenue later this month, additionally shaped in a better timeary way, and I can additionally stay it at the watch for a similar alternative.

In spite of everything, because of the information of swinging, AFRM He labored completely within the statement listing closing week and continues to accomplish a secondary step forward on Friday. So, I can proceed to search for robust alternatives to proceed the source of revenue hole, reminiscent of paperwork and hoods which can be doubtlessly tuned now.

Smartly, here’s a few intraday alternatives with a small capitalization:

*Please notice that costs and different statistics in this web page are hypothetical and don’t mirror the affect, if any, positive marketplace components, reminiscent of liquidity, slipping and fee.

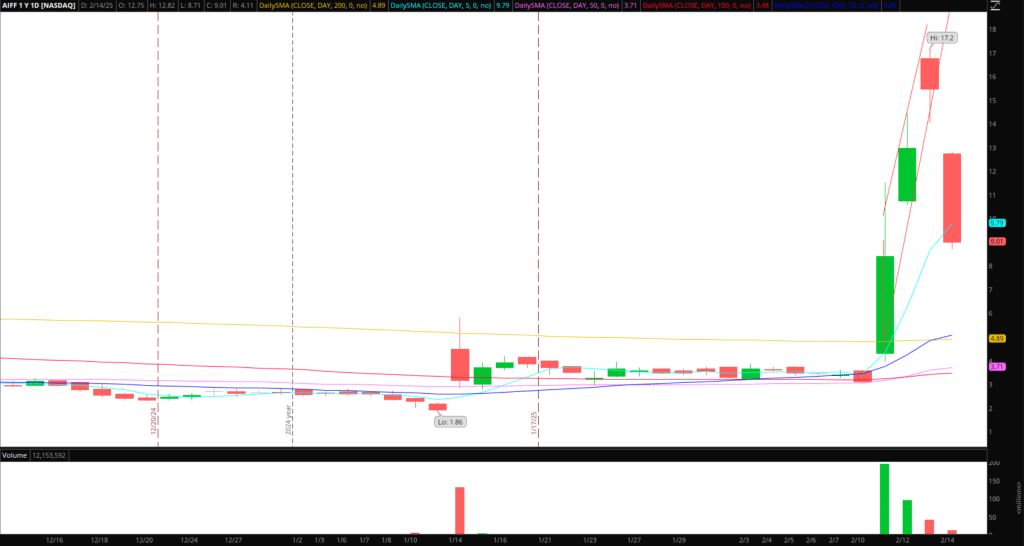

(Nasdaq: AIFF) In spite of everything, he broke the ascending pattern and offered on Friday. One day, I might have some notification for $ 11-13 in case it seems that in an volatile approach. If this occurs, I might search for a reactive intraudic quick alternative, and no longer swing.

*Please notice that costs and different statistics in this web page are hypothetical and don’t mirror the affect, if any, positive marketplace components, reminiscent of liquidity, slipping and fee.

(Nasdaq: mbrx) If there aren’t any further gives, I can pursue this for a possible liquidity entice and squeeze above Friday.

*Please notice that costs and different statistics in this web page are hypothetical and don’t mirror the affect, if any, positive marketplace components, reminiscent of liquidity, slipping and fee.

Get a Swing Swing rating template right here!

Necessary disclosures