Contemporary exams of crypto -experts admit that Bitcoin costs (BTC) are intently associated with the worldwide cash provide M2. In response to this, they expect a possible bull impulse for a crypto marketplace in overdue March.

With the growth of world liquidity, analysts expect that bitcoins and different virtual property would possibly revel in a vital rally ranging from March 25, 2025 and doubtlessly lasts till mid -Would possibly.

International M2 and its affect on bitcoins

The cash provide M2 is a large measure of liquidity, together with money, verification of deposits and simply convertible property close to cash. Traditionally, Bitcoin demonstrated a robust correlation with M2 fluctuations, since an building up in liquidity in monetary markets continuously stimulates the call for for selection property akin to cryptocurrencies.

Colin says Crypto, an analyst X (Twitter), emphasised this correlation, declaring a pointy building up within the world M2. He described this as a “vertical line” at the graph, signaling the inevitable surge of costs for property.

In line with his forecast, it’s anticipated {that a} rally for promotions, bitcoins and wider crypto -market will start on March 25, 2025 and lengthen till Would possibly 14, 2025.

“The global schedule of monetary offers M2 has just printed another vertical line. A rally for promotions, bitcoins and cryptor will be epic, ”he urged.

Bitcoin and M2 session. Supply: Colin says crypto on x

Vandell, co -founder of Black Swan Capitalist, confirms that world M2 actions without delay have an effect on the cost of Bitcoin. He notes that the lower in International M2, more often than not, is accompanied by means of a decline within the Bitcoins marketplace and cryptocurrencies in about ten weeks.

Regardless of the potential of quick -term disasters, Vandell believes that this cycle lays the root for a protracted -term upward development.

“As you can see recently, when the Global M2 decreased, Bitcoin and Crypto followed about 10 weeks later. Although a further drawback is possible, this is a natural part of the cycle. This liquidity shift will probably continue for a year, creating the ground for the next stage, ”Vandell defined.

In a similar way, every other common analyst, Michael Van de Poppe, considers the growth of M2 as one of the vital 5 key signs of the early restoration of the marketplace. He emphasizes that since inflation is not the principle objective and expectancies of the charges of the United States federal reserve device, monetary stipulations change into extra favorable for bitcoins.

“The bottom line is that inflation is not the main topic will probably decrease. Decrease in the rate of the Fed. The dollar for mass weakening. The profitability is to fall. M2 SUPPLY to significantly expand. And when this process began, this is just a matter of time, while Altcoins and Crypto. Bull, ”he stated.

Historic context and forecasts

The correlation between the cost of Bitcoin and the worldwide expansion of M2 isn’t new. Thomas, a macro economist, lately when compared the former marketplace cycles, particularly in 2017 and 2020. At the moment, a vital building up within the world M2 coincided with probably the most tough annual performances of Bitcoin.

“The money supply is expanding all over the world. The last two main global bursts M2 occurred in 2017 and 2020 – both coincided with mini bubbles and the strongest years of Bitcoin. Can we see a repeat in 2025? It depends on whether the US dollar is significantly weakens, ”Thomas famous.

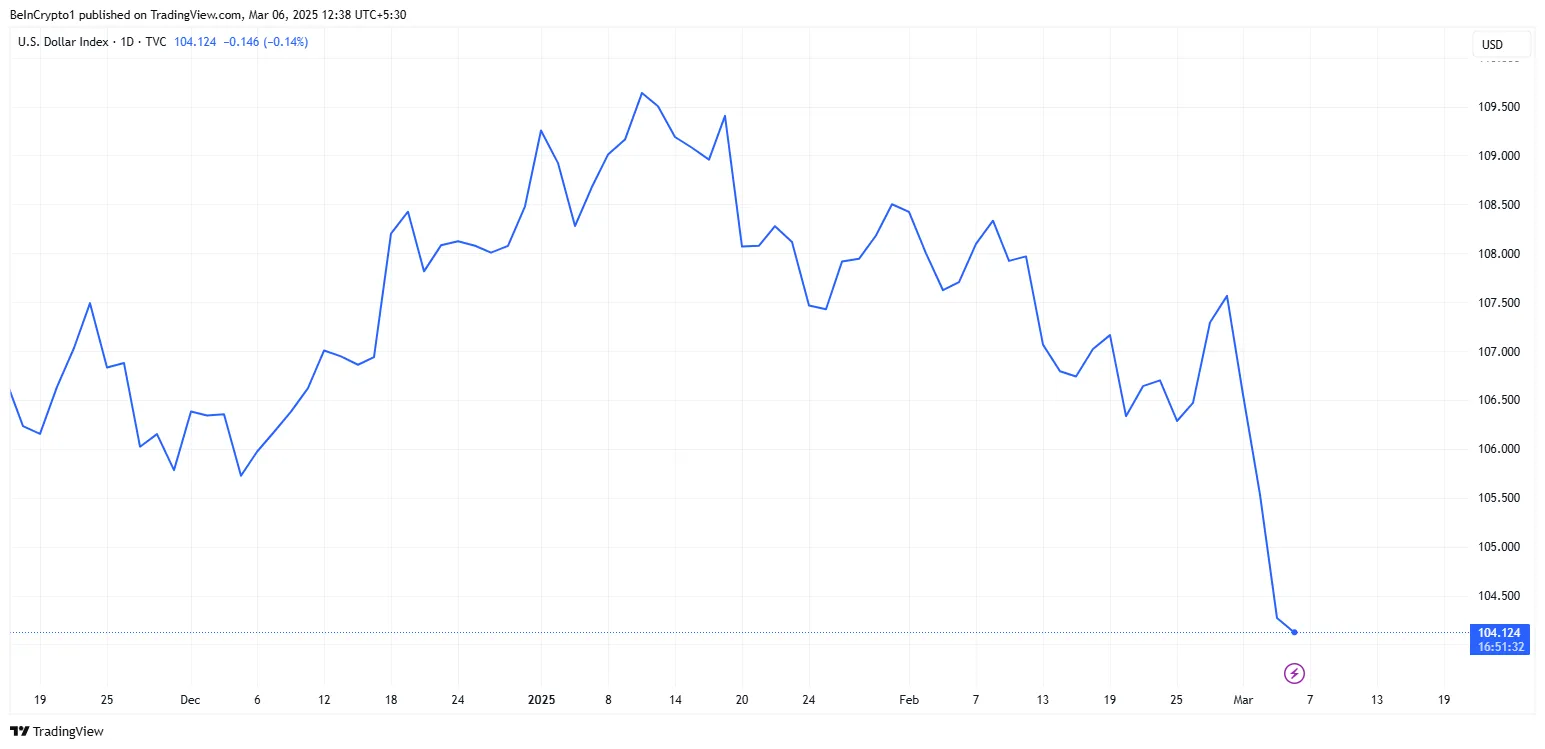

Thomas additionally emphasised the affect of the coverage of the Central Financial institution, indicating that despite the fact that the principle banks scale back charges, the ability of the United States buck is usually a restricting issue. If the buck index (DXY) falls to about 100 or decrease, it will possibly create stipulations very similar to the former Bitcoin Bull mileage.

DXY Efficiency. Supply: TradingView

DXY Efficiency. Supply: TradingView

The function of the federal reserve device

Macro researcher Jimin Suy believes that the federal reserve can prevent his quantitative tightening coverage (QT) in the second one part of the 12 months. This kind of step, says Yimin, can doubtlessly transfer directly to quantitative softening (QE), if it calls for financial stipulations. This shift could make further liquidity to the markets, refueling the ascending Bitcoin trajectory.

“I think that reserves can become too thin for the taste of the Fed in the second half of the year. I predict that they will stop QT at the end of Q3 or Q4, with a possible QE after that, ”Sui commented.

Thomas agreed, announcing that the present plan of the federal reserve device is to slowly building up the stability, which corresponds to GDP expansion. He additionally formulates that an enormous monetary match may cause a complete -scale benefit in QE.

Those issues of view recommend that there are uncertainty, together with the ability of the United States buck and attainable financial shocks. Nonetheless, a much wider consensus amongst analysts signifies an approaching bull segment for bitcoins.

Traders must behavior their very own analysis, since they proceed to look at macroeconomic signs within the coming months, anticipating whether or not the expected rally will likely be materialized.