For an investor who needs to guess on a discount available in the market, one of the vital most simple tactics to do that is with the unfold of a endure.

Description of the method

The distribution of the “bear” is composed of 2 choices: lengthy Put and brief Put. Two choices are blended shape “distribution”. The theory status at the back of one of these distribution lies in benefit from the lengthy -term model, having misplaced although with a brief approach. For the reason that brief bond is roofed in far, the lengthy choice may have a extra inner price after the expiration of the time period than a brief rating, which makes a benefit.

Right here is an easy instance: think that you simply watched the XXX stocks, which is lately buying and selling $ 25 in keeping with percentage. You consider that the impending source of revenue announcement won’t achieve expectancies, and the motion can see a vital lower. Making a decision that the easiest way to play one of these doable transfer is with a endure trail.

With the cost of stocks of $ 25, you made a decision to start up Endure Put the usage of the cost of a strike for $ 24 and 21. Thus, you concurrently purchase some degree of $ 24 and promote $ 1.50 bucks for a blank bonus of $ 0.50. Choices have 60 days earlier than expiration. The utmost benefit doable is calculated, for the reason that distribution between the costs for defeat ($ 24 US bucks $ 21 is the same as $ 3.00) minus an advantage of 0.50 US bucks for the utmost benefit of $ 2.50.

The utmost chance at this place is a top class paid plus any fee and costs. Within the above instance, due to this fact, the utmost chance is simplest 0.50 US bucks.

To get most benefit, the cost of stocks must lower to 21 bucks of america or much less after expiration. If the marketplace is decreased, however now not inside 21 US bucks or decrease, it could for sure be calculated as a protracted strike value of $ 24, minus an advantage paid at $ 0.50 for an interrupt stage of $ 23.50. Any motion between a leap forward stage of $ 23.50 and US bucks might be equivalent to benefit from the standpoint. For instance, if the motion was once on the stage of $ 22 after expiration, the benefit will calculate as non -compliance with 23.50 US bucks minus $ 2,22 for a benefit of $ 1.50.

After all, now not each deal will cross consistent with plan. Now think that for a second your forecast for stocks was once totally now not based, and the reserve does now not fall, however rises. On this case, if the cost of stocks exceeds the lengthy blow to $ 24 after expiration, you are going to lose all of the bonus paid within the quantity of $ 0.50.

Unfold and loss scheme

When to position an account

The unfold of a endure can be utilized both for a endure forecast in inventory, or for terribly low ranges of implied volatility. If you happen to assume that the stocks or different belongings magnificence are because of a fall, the unfold of endure owls will also be an effective way to play this opinion with restricted chance and respectable benefit.

For the reason that choices additionally impact the degrees of implied volatility, you’ll additionally use the bearish to precise reviews at stage IV to precise opinion at stage IV. On this case, the marketplace does now not also have to transport under to make a benefit. Business probably makes a benefit from expanding intravenous enter, which may end up in an building up in choices.

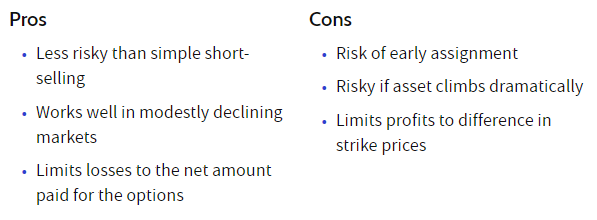

Professionals of the method of the unfold of the endure

The unfold of endure pile has plenty of doable benefits. Possibly the largest good thing about this sort of distribution is its sure chance. Irrespective of what the marketplace does, the investor can’t lose greater than the bonus paid for this place.

The sale of the PUT choice with a lower cost of the affect is helping to catch up on the price of purchasing an choice PUT with the next value of the affect. Subsequently, the web value of capital is not up to purchasing a unmarried level.

This sort of distribution too can probably carry the next go back on funding or profitability of funding in comparison to the industry of fundamental stocks or contract. That is because of the truth that the sale of stocks calls for a margin, and the investor will have to pay a lot more capital to promote brief ones in comparison to the acquisition of non-compulsory distribution.

Cons of the method of the unfold of the endure

Since distribution makes use of choices, it’s subjected to a large number of dangers which might be delivered with a place with a length. Because of the truth that the choices have a restricted carrier lifestyles and the date of expiration, they are going to lose price over the years when all different entrances stay consistent. The unfold of a endure standpoint too can lose cash, even supposing the marketplace is decreased from a pointy fall within the implied stage of volatility.

Choices impact a number of key components, together with stage IV, time and value. Which means that the dealer must now not simplest be proper in terms of the course of the marketplace, however must even be proper in terms of time and different components.

Possibility control

There are lots of other colleges of idea with regards to managing a bearish unfold. The chance control strategies used will also be in line with value, time and value. For instance, a easy chance control approach is to near the placement whether it is decreased within the that means. The usage of the former instance above, if you happen to purchased a range at the nook for 0.50 US bucks, and it diminished to $.

Every other approach comprises time earlier than expiration. If you happen to purchased a scatter of Put 90 days earlier than the expiration of the expiration date, you’ll make a decision to near the victory, lose or draw once 30 days left.

The corresponding chance control strategies can rely on tolerance to the chance of the investor, marketplace stipulations and different components. What sort of approach will get out, an important factor is to have a plan, after which adhere to it.

Imaginable changes

The unfold of endure pile may also be adjusted as buying and selling expands. For instance, if the marketplace started to head with desire, however the choices remained just for a little while, till they expire, you’ll select a “turn” place. This comprises the sale of the present distribution and the acquisition of the similar distribution and even the usage of quite a lot of blows within the later date of expiration.

In case you have noticed a big passion benefit from a range that also has numerous time left, you’ll make a benefit and purchase a brand new unfold this is additional (even decrease blows).

Bearish Put from is an easy however very tough technique that even amateur choices investors can use. Because of a undeniable chance and traits of doable benefit, it must be a very powerful device in a suite of equipment for any dealer.

The essence

A The worries of the proposal An impressive selection to promote brief stocks or purchases in instances the place a dealer or investor need to take into consideration decrease costs, however don’t need to make nice capital in industry or don’t essentially be expecting a vital aid in the fee.

In any of those instances, a dealer can provide a bonus for himself, exchanging a range, and now not simply purchasing put choice.

Concerning the creator: Chris Younger has some extent of arithmetic and 18 years of monetary revel in. Chris British towards the backdrop, however labored in america not too long ago in Australia. His passion within the choices was once first brought about by way of the “Trading Options” segment by way of the Monetary Occasions (from London). He made up our minds to put across this information to a much broader target audience and based Epsilon Choices in 2012.

Subscribe to strong now and revel in all of the energy of choices promoting handy. Click on the button under to start out!

Sign up for Steadyopts now!