The crypto -market continues to stand gross sales force, for the reason that merchandise for funding in virtual property recorded their greatest weekly outflows.

The units stay acidic, since Bitcoin (BTC) slightly stored above the mental stage of $ 90,000, in spite of the Crypto -Crypto President Donald Trump.

Crypto -See See New Posts

During the last week, cryptoopahs reached surprising $ 2.9 billion, because of which a 3 -week general of as much as 3.8 billion greenbacks. This notes the 3rd week in a row of capital, which matches to the cryptographic sector, and sharply contrasts with the former 19-week sequence of tributaries, because of which it poured $ 29 billion available on the market.

In the most recent CoinShares record, adverse flows are attributed to weakening moods within the cryptography marketplace. It provides components reminiscent of the new BYBIT hacking amongst key components that give a contribution to set up outfills. Others come with a extra hawk place from the federal reserve machine and wider macroeconomic issues.

“We believe that several factors contributed to this trend, including the recent BYBIT hacking, the more hawk federal reserve and the previous 19-week series of tributaries totaling $ 29 billion. These elements probably led to the combination of a deal with profit and weakening of moods to the class of assets, ”the record within the record.

In line with Beincrypto, a hacking, which resulted in stolen thousands and thousands of greenbacks, used to be surprised by means of the arrogance of buyers. This complements fears concerning the vulnerabilities of safety within the crypto -space. As well as, the most recent feedback of the federal reserve machine marked a cautious view of the inflation and US GDP, which led to a much broader marketplace uncertainty and a lower in chance urge for food.

In contrast background, Coinshares researcher James Batterfill identifies bitcoin as probably the most tricky, which is the most important temper, experiencing an outflow of $ 2.59 billion closing week. Ethereum used to be additionally injured by means of recording the best weekly outflows of $ 300 million. Different primary altcoins adopted his instance when Solana survived an outflow of $ 7.4 million.

Crypto -flow closing week. Supply: Coinshares

However, brief positions in Bitcoins noticed minor inflow for a complete of two.3 million greenbacks, which implies that some buyers place themselves for additional downside.

Regardless of the overall adverse temper, some virtual property noticed an inflow. SUI turned into the most efficient performer, attracting $ 15.5 million. USA, and XRP adopted $ 5 million. Those advantages recommend that even though the broader marketplace is beneath force, sure tasks proceed to obtain the hobby of buyers.

For the XRP, the temper stays constructive, managed by means of an build up within the expectation of an answer in america (securities and trade) on XRP ETF. The time period for the SEC for approving or deviation of sure ETF packages has begun. Buyers nonetheless hope that XRP can be clarified by means of law. Together with XRP within the crypto -prisoner of Trump in the United States can make stronger this opinion.

Regardless of this, the closing spherical of Ottokov follows the tendency advanced over the last few months. Within the earlier week, the outflow of cryptoodium amounted to 508 million greenbacks, which additional annoyed the fears of buyers. Ahead of that, knowledge on hawk rhetoric of the federal reserve machine (CPI) associated with the patron worth index (CPI)

This sequence resulted in the truth that some analysts indicated macroeconomic components as the principle gross sales issue, whilst the temper of buyers nonetheless confirmed worry.

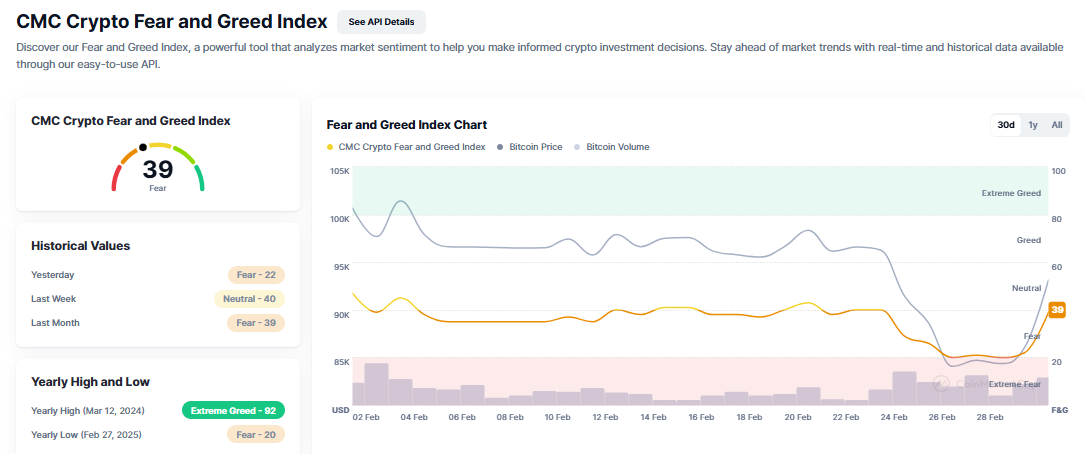

Crypto -page and greed index. Supply: Coinmarketcap

Crypto -page and greed index. Supply: Coinmarketcap

However, others argue that overseas politicians, reminiscent of President Donald Trump President, contributed to an unsure marketplace atmosphere, inciting inflation fears and making dangerous property, reminiscent of crypto.

A competing prospect means that structural shifts, together with money and buying and selling methods, can give a contribution to the new instability of Bitcoin.

Bitcoin worth efficiency. Supply: Beincrypto

Bitcoin worth efficiency. Supply: Beincrypto

On the time of writing this text, Bitcoin is buying and selling for $ 93,095, which opened 8% from the instant the consultation used to be opened on Monday.