That is the principle tenant of the way the choices are evaluated, and frequently a dealer with probably the most correct forecast of volatility, which wins in the longer term.

Whether or not you love it or now not, you adhere to volatility at any time whilst you purchase or promote the choice. When purchasing an choice, you assert that volatility (or how a lot the marketplace the choices believes that the fundamental will transfer sooner than the expiration of the validity) is affordable, and vice versa.

Due to volatility as a cornerstone, some buyers choose to totally end the prediction of costs and as an alternative business at the foundation of the ebb and flows of volatility within the impartial marketplace.

A number of choice spreads permit such insupportable business out there, and deterioration and restrictions are construction volatility business blocks.

However even although Straddles and Strangles are requirements, they from time to time depart one thing, what is wanted for buyers who wish to specific a extra nuanced opinion concerning the marketplace or prohibit their have an effect on.

Because of this, there are spreads equivalent to iron condors and butterflies, permitting buyers to guess at the alternate within the volatility of the choices marketplace with changed chance parameters.

These days we will be able to communicate concerning the Iron Condor, one of the incorrectly understood choices, and about scenarios the place the dealer might wish to use iron condor in want of brief strangulation.

What is brief strangulation?

Sooner than we amplify Iron Condor and what makes it tick, let’s get started with the truth that we’re experiencing a brief strangulation, a method with brief volatility, which many imagine as construction blocks for an iron condor. Iron Condor is, in truth, only a hedged brief concept, so that you will have to perceive them.

The strangler comprises issues with a borrowing and calling OTM, each in the similar expiration. An extended strangulation comprises the acquisition of those two choices, whilst a brief strangulation comprises their sale. The aim of the transaction is to guess on adjustments in volatility, now not keeping an immediate have a look at the route of the associated fee.

As mentioned, the “stranglers” and “Straddly” are construction blocks for the service provider of the volatility of the choices. Extra advanced spreads are created the use of a mix of stranglers, restrictions and “wings”, which we will be able to imagine later within the article.

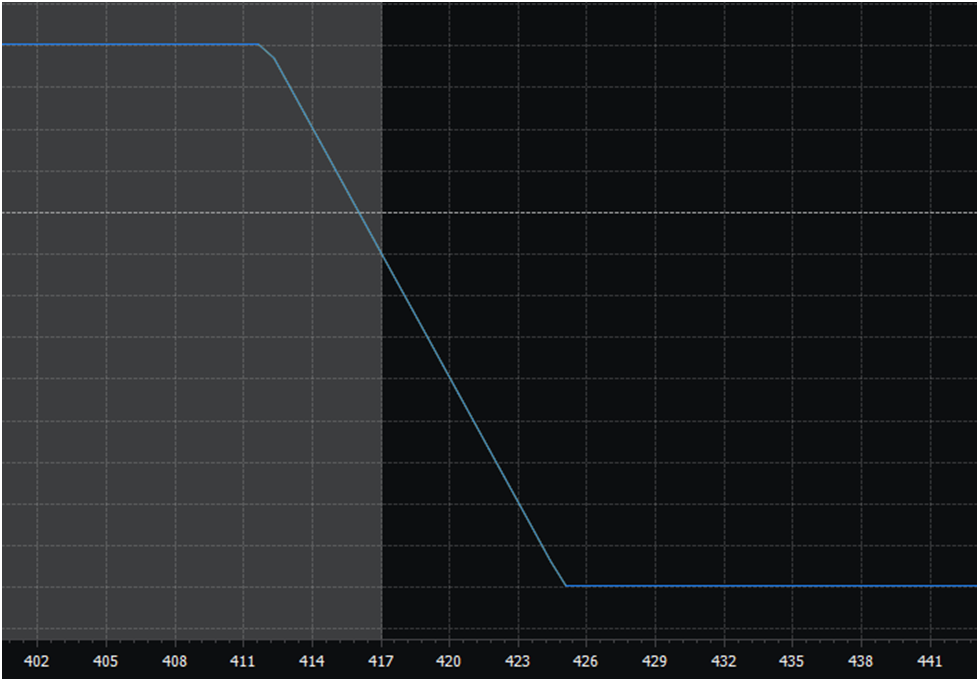

Here’s an instance of a brief soul textbook:

The aim of this business is to make certain that fundamental business within the vary of 395-405. If this occurs, each choices expire are unnecessary, and also you make investments all the mortgage that you simply accumulated whilst you opened the deal.

On the other hand, as you’ll see, you start to acquire losses, for the reason that marketplace is going past this shaded grey space. You’ll simply calculate your smash -in degree via including a transaction mortgage to every of your blows.

On this case, you accumulate $ 10.46 to open this business, so your hole ranges are 415.46 and 384.54.

However that is the place the possible downside arises. As you’ll see, a conceivable loss on this business isn’t decided. If the fundamental move to Seyvir, it’s unattainable to mention the place it may be after expiration. And you’ll be on a hook for these kinds of losses.

Because of this, some buyers try for spreads, equivalent to iron condor, which permits a gamble at the volatility within the impartial marketplace, figuring out your most chance in business.

Iron condors endure with “wings”

Iron condors are marketplace choices used for making a bet on adjustments in volatility. The important thing good thing about iron condors is their assets with a definite chance in comparison to recesses or restrictions. Limitless chance of struggling or restrictions

Iron condors are superb possible choices for buyers who should not have temperament or margins for promoting restrictions or deepening.

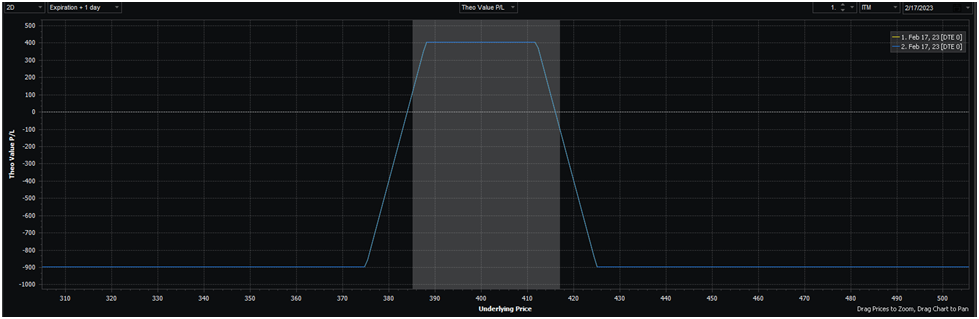

Distribution is composed of 4 contracts; Two calls and two confusion. To simplify, let’s create a hypothetical. Our fundamental secret agent is 400. Most likely we expect that the implied volatility is simply too top and we wish to promote some choices to benefit from this.

We will get started with the development of 0.30 Delta Straddle for this. Let’s use the similar instance: Promoting 412 calls and 388 techniques. We’re offered with the similar fee scheme as above. We adore that we’re amassing some large bonuses, however we don’t like this imprecise chance.

With out making use of labels to the rest, what can be one of the best ways to restrict the chance of this usually accredited? The object and the decision, which is deeper than our state of affairs. It’s fairly simple. We will simply purchase further choices. Those are all iron condor, pruning with “wings”.

In a different way to have a look at iron condors is that you’re construction two vertical spreads. In any case, if we scale back the diagram of the fee of iron condor in part, it is the same to vertical distribution:

Here is what the usual iron condor might seem like when the bottom worth is 400:

● Purchase 375 Put

● Promote 388 Put

● Promote 412 name

● Purchase 425 name

The fee scheme looks as if this:

The verdict to make use of iron condors towards brief strands

Have you ever ever puzzled why {most professional} choices traders, more often than not, are natural dealers of choices, even if they’re in the beginning look, it kind of feels that you’ll make large choices for purchasing a house levels?

Many herbal purchasers within the choices marketplace use them to hedge an absence of their portfolios, if it is purchasing wraps or calls.

Actually, they use choices as a type of insurance coverage, like a house owner in Florida, purchasing hurricanes now not as a result of this is a successful price, however as a result of they’re able to overpay just a little for his or her non secular calm, that their lifestyles is probably not grew to become the wrong way up at the head of a typhoon.

Many buyer choices (now not all!) Paintings in a similar way. They purchase, put the S&P 500 to give protection to their stocks portfolio, they usually hope that the wagons expire are unnecessary, similar to the home-owner of Florida prays that they by no means truly had been to make use of hurricanes.

This behavioral displacement within the choices marketplace is the results of a marketplace anomaly referred to as a prize for the chance of volatility. The whole thing that suggests is the implied volatility, more often than not, upper than the learned volatility. And, subsequently, the online over choices can strategically make transactions to be used and benefit from this anomaly.

On the other hand, there’s a caution. Any supply of go back that exists has some problem, in addition to money back profile, which will not be preferrred in change for a go back to your usual. Due to the sale choices, the chance profile scares other folks from amassing this benefit.

As you already know, gross sales choices have theoretically limitless chance. This can be very necessary to take into account that when promoting a choice, you promote somebody the proper to shop for fundamental stocks at the cost of a blow. Promotions can upward thrust to infinity, and you’re at the hook to satisfy your aspect of the transaction, irrespective of how top it’s completed.

Thus, whilst a good anticipated method to business from a brief aspect will also be, many don’t wish to settle for any such large, imprecise chance.

And that is the place such spreads as Iron Condor seem. Further calls and calls from cash, frequently referred to as “wings”, prohibit your losses, which lets you brief volatility with out the possibility of the crisis.

However this isn’t a unfastened lunch. You sacrifice doable benefit to verify protection from a catastrophic loss, obtaining those two OTM choices. And for plenty of buyers, that is too top the associated fee for amassing VRP.

In nearly any case, the rear checks or simulations, brief stranglers turn into a transparent winner, as a result of hedging, more often than not, is in. For instance, take this CBOE index, which screens portfolio efficiency per thirty days .15/.05 Delta Iron Condors on SPX since 1986:

As well as, there’s a attention of commissions. Iron condors consist of 4 contracts, two tunes and two calls. Because of this Iron Condor commissions are two times up to that of brief peculiar fashions at the fashions of the Choice Industry Fee.

Because the Retail Industry Industry Fee entered the retail business, overcoming about $ 0.60 for a freelance, that is 4.80 US greenbacks to open and shut iron condor.

That is fairly a drawback, since maximum iron condors have a moderately low benefit of the utmost, this means that that fee can frequently exceed 5% of the utmost benefit, which has a super affect to your result of the predicted price.

In the end, you have got relating to anticipated price and further commissions to put on iron condors. Thus, you will have a resounding reason why for the buying and selling of iron condors in want of brief strands.

Consequence

Too many buyers are caught within the considering “I am an income merchant” when the marketplace is simply too chaotic and dynamic for any such static manner. The truth is that on this time there is a perfect technique for tolerance for chance, on this fundamental.

Now and again the whole marketplace regime calls for a brief volatility technique, whilst others require extra nuanced approaches, equivalent to a calendar unfold.

There are occasions when it is smart to business in iron condors, when the implied volatility, as an example, is terribly top. It’s top sufficient for any brief Vol Technique prints cash, however too top to be bare brief choices. In a similar way, there are occasions when iron condors are a ways from preferrred distribution for business.

Every other comparability is iron condor towards. Iron butterfly

Like this text? To obtain additional info, talk over with our weblog concerning the schooling and business in choices.

Comparable articles