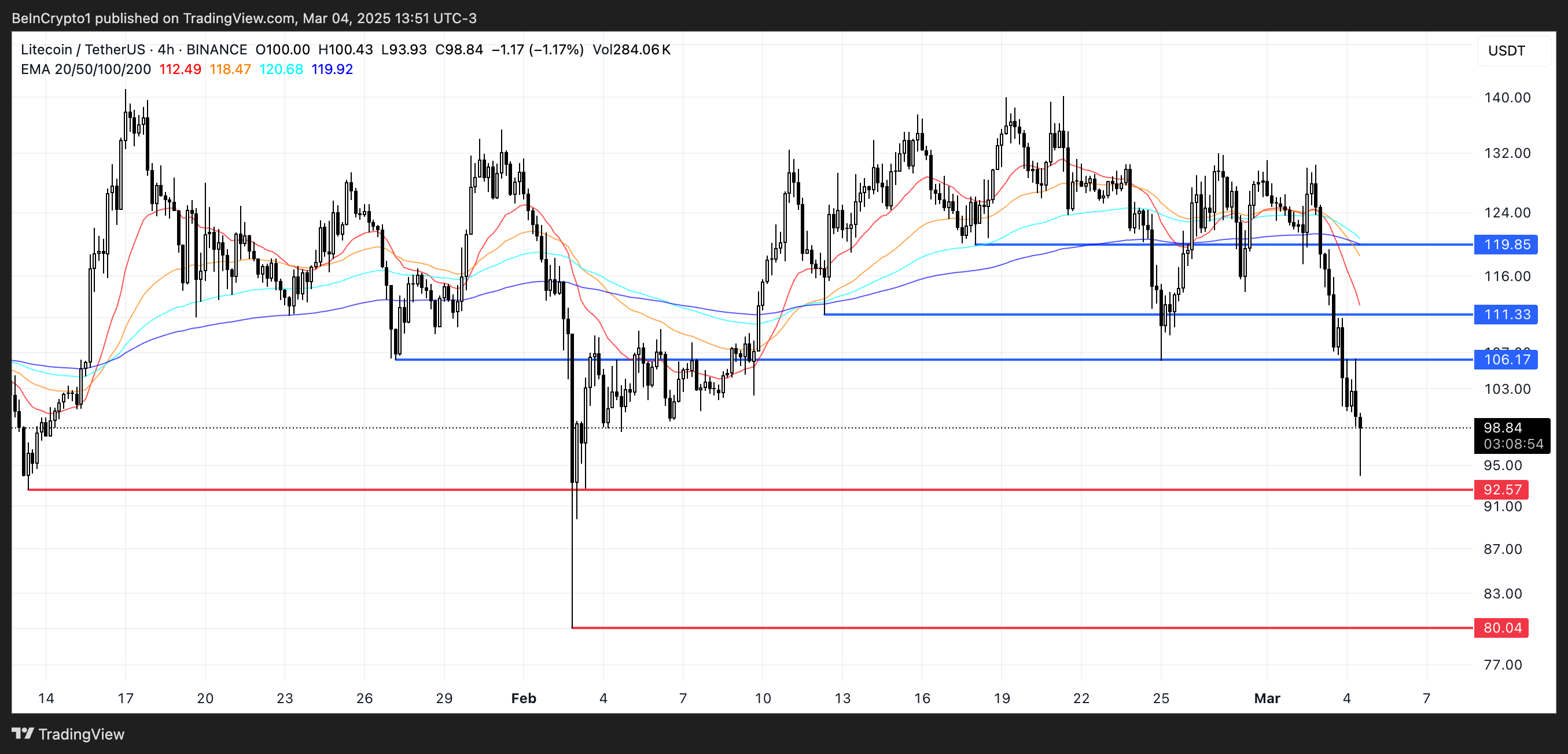

Litecoin (LTC) has reduced by means of greater than 12% over the last 24 hours, and its worth is traded by means of $ 100, and marketplace capitalization has fallen to $ 7.5 billion. A pointy lower happens because of higher gross sales power, which promotes RSI LTC to the resold territory and the CHAIKIN (CMF) money glide to adverse ranges.

If the descending development continues, LTC can take a look at make stronger within the quantity of $ 92.5 and doubtlessly lower to $ 80, which is the bottom worth since November 2024. Alternatively, if the impulse is shifted, LTC would possibly attempt to get better, having a look up above $ 100 and aimed toward resistance ranges on the stage of $ 106, US bucks and, most likely, $ 119.

LTC RSI is these days at resale ranges

The Litecoin (RSI) relative pressure index fell to 26.7, which is a pointy lower from 57.1 best two days in the past. This steep fall signifies that LTC has entered right into a reassessment of the territory, which provides in depth gross sales power.

This type of fast fall incessantly displays a panic sale or a robust undergo tendency, leaving LTC susceptible to additional lack, if best consumers intrude.

Nonetheless, RSI this minimal additionally indicators that the asset would possibly way a possible quick -term alternate, for the reason that prerequisites of resold incessantly result in rebukes of aid.

LTC RSI. Supply: TradingView.

RSI is a hallmark of the heart beat that levels from 0 to 100, measuring the energy of latest worth actions. The symptoms above 70 point out the phrases of chunk, when the property are more likely to confronted gross sales power, whilst the indicators underneath 30 are urged by means of the resold prerequisites the place the acquisition chances would possibly seem.

With RSI LTC these days at 26.7, it’s situated on a deep territory, expanding the probabilities of a brief -term rebound.

Alternatively, if a undergo’s impulse persists, and RSI continues to fall, Litecoin can take a look at his highest to search out make stronger and build up his losses till any try to repair.

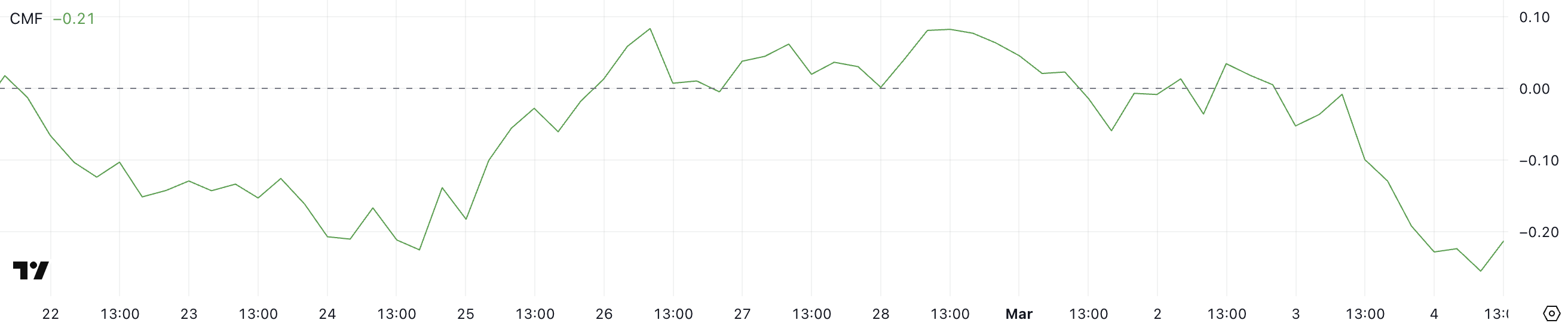

Litecoin CMF fell underneath -0.20

Cash Glide Chaikin from Litecoin (CMF) is these days -0.21, in comparison with 0.03 best two days in the past, which signifies an important shift within the capital glide. Previous, CMF fell for a short while to -0.26, which is on the lowest stage since mid -February, strengthening undergo moods.

A lower in CMF means that gross sales power will increase, whilst extra capital flows from LTC than in it.

This development indicators that traders pull liquidity from Litecoin, which makes it tough to care for any quick -term rebounds.

LTC CMF. Supply: TradingView.

LTC CMF. Supply: TradingView.

CMF measures the power at the acquire and gross sales, inspecting volumetric and worth actions within the vary from -1 to at least one. Certain values point out the buildup, which means that that more cash is going into the asset, whilst adverse values recommend the distribution and build up in gross sales power.

With CMF from LTC now at -0.21, dealers stay beneath keep watch over, and if the acquisition of the go back quantity, LTC can take a look at their highest to search out make stronger.

A contemporary fall to -0.26 presentations that the outflow of capital reaches excessive ranges, which will increase the chance of additional drawback, if best the temper shifts.

Will Litecoin quickly fall underneath $ 90?

If the Litecoin Down Development will proceed, the cost can take a look at the make stronger stage of $ 92.5, the important thing space that in the past held consumers. If this stage is misplaced, LTC can fall in simply $ 80, noting the bottom worth since November 2024.

With such pulse signs as RSI and CMF, appearing undergo power, additional lower stays the chance if consumers don’t input into pressure to give protection to make stronger.

LTC costs research. Supply: TradingView.

LTC costs research. Supply: TradingView.

Alternatively, if LTC reverses its development, it may possibly repair the impulse and lift greater than $ 100, and $ 106 as the primary primary stage of resistance.

The step forward above this may end up in a check of $ 111, and if the bull impulse intensified, LTC can acquire at $ 119.