Insider acquire and sale

On the identical time, we compete with quantitative research, which unfolds masses of hundreds of thousands of bucks into identical issues and infrequently draws a retail investor with any merit. It’s supplied by means of legislation, on the other hand, there are a selection of items that we – the retail investor – too can see (or as badly) as everybody else, and this kind of issues is insider purchases. From the grey zones within the reporting and execution of transactions, the precise time isn’t what’s maximum essential, it’s only the pinnacle that insiders purchase.

Why that is important, neatly quote one of the vital outdated nice investments:

“Insiders can sell their shares for any number of reasons, but they buy them only for one: they think that the price will rise.” – Peter Lynch

The acquisition of insiders is a lot more important than the sale, as a result of such a lot of causes can result in the truth that an individual would require cash that has not anything to do with the corporate into account, probably the most obviously ubiquitous is divorce! The acquisition is abnormal, as a result of those that are engaged on this in reality building up their publicity to the motion into account, after they typically already paintings within the corporate, and along with this, more often than not, it’s really helpful from choices for stocks or plans of the corporate. Every now and then, the Director Normal/Monetary Director should display self assurance in his personal corporate, purchasing (keep away from those eventualities), however basically, the Mill Insider insider purchaser truly has no explanation why to shop for, apart from that they suspect that the entirety seems just right for stocks. From the standpoint of bets, insiders purchase their doubling for the already very nice significance of the good fortune of the corporate in query.

Peter Lynch used to be an overly guy who believed that you just will have to spend money on movements that you realize. An instance that he gave an “unexpected” insider acquire (this is, unregulated) used to be the firefighter of the Fifties, offering fireplace protection rounds within the commercial zone round Palmer Massachusetts, who needed to proceed to make bigger the process his spherical from a specific corporate (Tambrand), increasing. Now not realizing what they did, he purchased stocks within the corporate in query and retired by means of a millionaire by means of 1970. In the similar good judgment, I invested (for my mom’s portfolio) in NVDIA again in April 2016 – why? My corporate undertook for its industry (we didn’t obtain it), and their public request for proposals used to be the primary record that I’ve ever learn, which made me that means in regards to the technique for AI (in truth independently managed automobiles). Those two examples have a caution inherent in them, and the quote from Peter Lynch is ceaselessly given, however his 2nd advice is never reported:

“The search for a promising company is only the first step. The next step is the study. ” – Peter Lynch

NVDA case

The placement with NVDIA used to be for instance, investments made for my mom have been in keeping with her various portfolio and working out of semiconductors. The excellent request for proposals used to be no longer the one explanation why to make a choice to make an immersion, it used to be mixed with different concerns, and that is the way you will have to come on the subject of all insider purchases. It used to be very attention-grabbing Reddit Put up The truth that we shamelessly scouse borrow from use as a learn about on this article. You notice, no longer all purchases of insiders all the time result in good fortune.

Determine 1 Supply R/Choices on Reddit 02/25/2024

The above learn about carried out by means of Redditor illuminated the 3-year duration and gives sobering studying for individuals who imagine that that is only a query to blindly observe insiders. Even though the publish most probably needed to make you subscribe to Insiderxtrade.com, it used to be moderately instructive. The duration covers 3 years to the second quarter of 2023, which used to be a specifically tough setting at the inventory marketplace. We will conclude that the smallest capital movements are attention-grabbing best in shorter time frames, and it’s conceivable that customers of medium and bigger capital insiders are extra about what they’re doing. This research adopted the older research, which used to be much less granular, but additionally got here to the belief that the easy industry in S&P gave a extra certain benefit, however because the profitability of the insider purchaser become winners, they have been nice winners than S&P with some margin. So it’s transparent what we do, it can not simply purchase when insiders purchase.

Who will have to observe?

This returns us to the similar query: we should best observe the best insiders, however the query is, which ones?

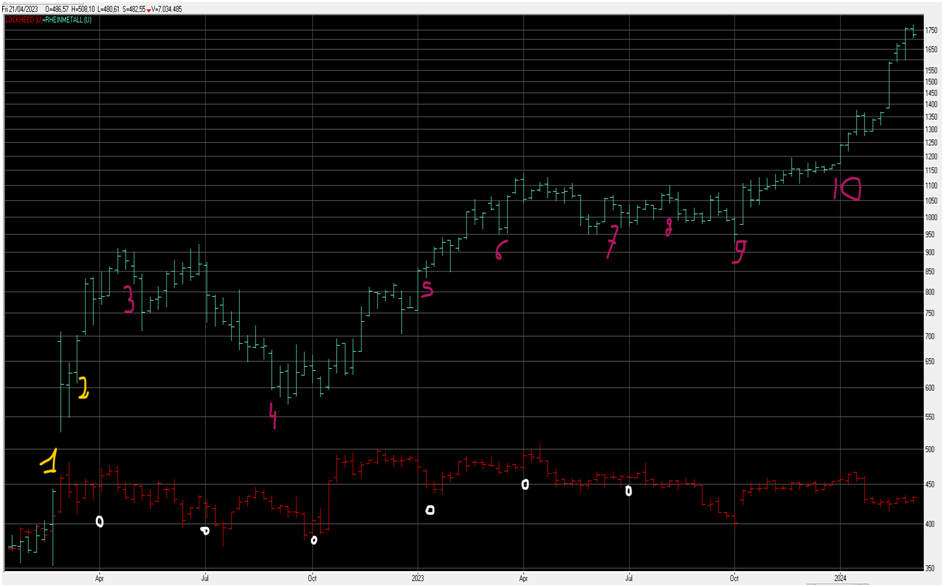

The solution is that we should observe the ones the place different issues let us know that the motion in query may also be attention-grabbing, however we don’t seem to be certain within the common time to go into the upward pattern. The theory of Warren Buffete that what has grown closing 12 months will develop subsequent 12 months is a truism this is tough to observe in follow, once we inevitably make a selection one motion, which the noksun, in spite of the big name earlier 12 months. An instance of a reasoned means the usage of an insider acquire is given underneath for 2 corporations in protection. IN RED That is Lockheed Martin (LMT) and in BLUE The German inventory marketplace quotes the protection corporate Rheinmetall (rhm.de).

To know the diagram underneath, word that for each corporations – as standard for any cited corporations – they’re topic to sure quarterly home windows of acquire and sale, which might be simply known by means of bearing in mind the time of purchases Insider.

-

Glass 1 and a couple of on yellow are public occasions similar to 2 stocks into account, specifically Russia’s invasion of Ukraine and the announcement of the German Chancellor “Zeitenwende”. That Bob Dylan merely stated: “Times are changing.” This coincided with a package deal of protection prices of 100 billion euros to modernize the German military. No prizes for the guessing that each topics are related for defense, however the place the primary tournament led them each; The second one best raised a German corporate. Whilst American corporations in protection make more money – the few closing in Europe will develop quicker after they start with a miles decrease base. This made them attention-grabbing for making an investment.

-

Little White Dots is an insider acquire at LMT – in truth, that is one individual: John Donovan, who used to be no longer fortunate in his selection. LMT experiences 30 insider transactions in keeping with 12 months – principally executions and gross sales. John is a lonely bull and unites his publish of LMT director from the publish of director in Panw;

- Purple red numbers are purchased by means of Rheinmetall insiders – in truth, there are best two gross sales right through this era, and they’re from one one who has additionally got many stocks. Each and every quantity is between ~From 3 to six insiders they purchase stocks. When you best have best 33,000 staff, and the truth that they file 10 transactions in keeping with 12 months, the adaptation between LMT and them is much more outstanding.

The variation in efficiency is massive with Rheinmetall, simply forward of LMT, however, as may also be noticed from (3), no longer all purchases have been essentially calculated. The meteororic enlargement of stocks in early 2022 resulted in a not unusual pause wherein the corporate used to be no longer productiveness, however the common marketplace precipitated the stocks. The insiders persevered to shop for always, and it used to be right here that the mix of the corporate, which is in a just right position together with solid insiders, and is not likely to make any gross sales convincing. Lonely John Donovan isn’t from his pocket, however, after all, a bunch of consumers in Rheinmetall in Rheinmetall, which won maximum. The differential is that in terms of the Germans there used to be a lot more than only a regional battle as a way to building up the cost of stocks that are meant to take note of what the insiders did. Principally, they verify that the ascending pattern will have to closing if you find yourself insiders, and you recognize that the top of a just right factor in The sight you’re promoting, and, after all, don’t purchase.

Affirmation of the fashion

This leads us to the 3rd means to take a look at the insider acquire in every other mild – as a affirmation of a damage of the fashion in opposition to the certain. Till now, we’ve got studied the insider acquire as one thing in keeping with stocks, secretly hoping that some magnificent perception controls insiders and that we will make a benefit from the affiliation. It is going with out pronouncing that insider buying and selling isn’t allowed, and subsequently it is smart to take a look at the insider acquire on extra meteries.

You probably have invested for a while, you might have skilled a decline available in the market – my first revelation used to be the 1987 twist of fate, however lots of you’re going to keep in mind the cave in of the marketplace after Covid, Dot.com, a considerable or state lengthy disaster, and so forth. Warren Buffett all the time lighting up (and comforts us) along with his quote that the flag comes out when the marketplace leaves, as a result of in the home of the buffet it’s just right when the Hamburgers turn into inexpensive. The truth is that we, it kind of feels, can by no means make sure that the marketplace is not going to pass additional. Enjoy tells us that if you are going to buy someplace subsequent to the marketplace Nadir – in truth, in a somewhat extensive space of Nadir – the restoration is very tough. That is the kind of “buy and hold” on steroids, however our worry has a tendency to distract us from making an investment on the proper time, after which glance again, we mourn that: “It was obvious that this pandemic would leave one day.” Or some roughly similar new growth adopted the bust that made us surrender.

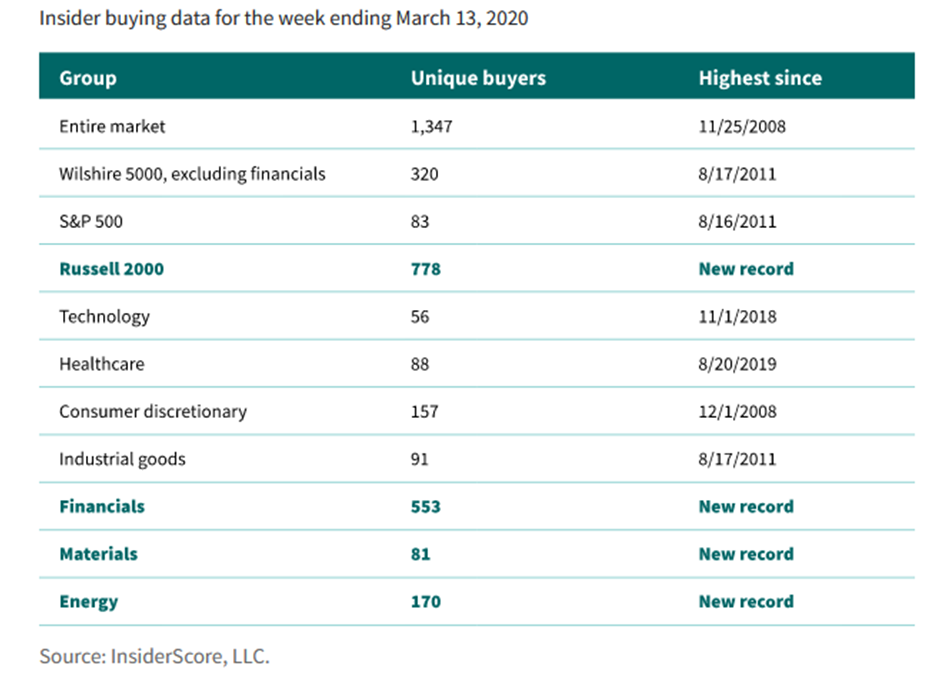

Research underneath is once more “investigated” Putnem However an attractive just right information for every other take a look at the insider acquire. They spotted the next in 2020 after Covid Armageddon:

In keeping with them, those have been the degrees of invisible, however what makes their research attention-grabbing is that in this foundation they made a call relating to the place they are going to make investments. They selected the serious cyclic facet of the marketplace as the person who used to be scored probably the most, and this tenden is restored quicker when the recovery is incorporated after the “death and darkness” is dispatched.

Now it’s too overdue to take a look at the insider acquire within the duration – no less than at the NASDAQ site – but it surely should be assumed that at their selection the FCX promotion had its personal proportion of insider purchases. It is usually very delicate to the cost of copper, which in itself is at once associated with financial task: financial enlargement with out copper, and its worth has turn into bell climate for the average financial system, since electronics started to dominate in our lives.

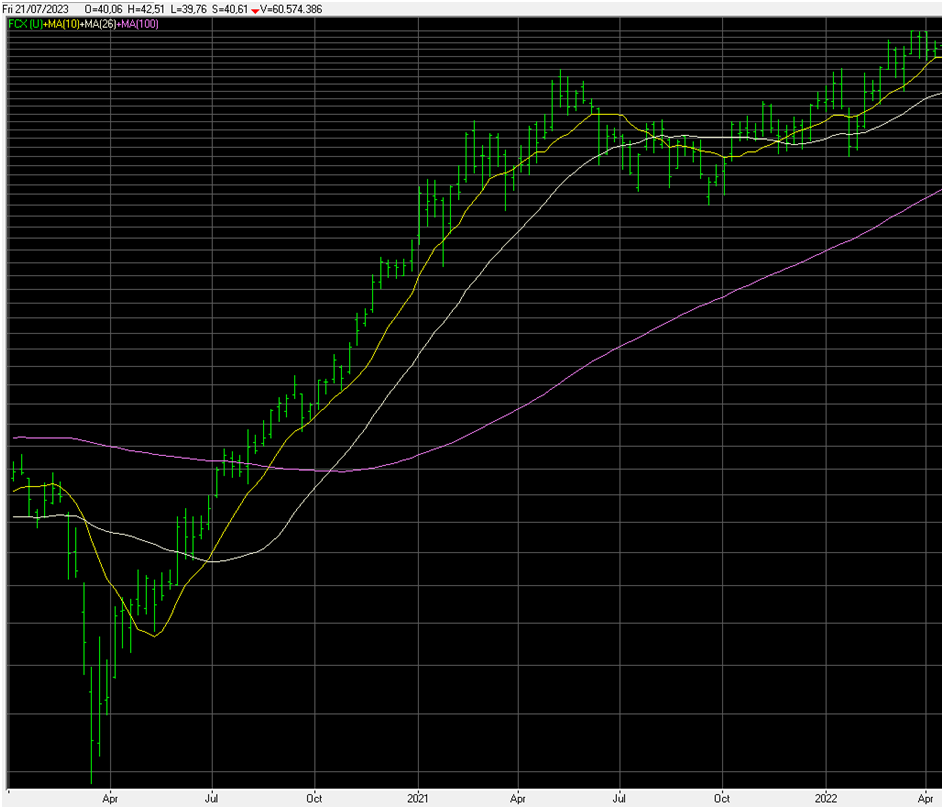

Determine 2 FCX diagram from 01.01.2020 to 04/2022

As may also be noticed from the diagram above, pUtan should have succeeded, however, frankly, it used to be no longer required a genius to determine, neither quantum get right of entry to to information and even pricey equipment. After all, it is advisable to no longer immerse your self, however you’ll be able to be roughly proper: even a month or 3 will likely beI used to be advantageous. The important thing level used to be a mix of insider acquire and working out of different rally drivers (on this case, the conclusion that the marketplace used to be in keeping with from extensive insider purchases and copper costs).

The essence

The belief of this publish is that insider purchases don’t seem to be an instantaneous cause for funding, however merely an invaluable sign in sure instances. Choices are perfect for the usage of those indicators, as a result of they are able to lend a hand play the marketplace extra subtly than candid purchases may also be. The method to the correctly below learn about insider state of affairs is also to shop for a bounce and promote some quick choices towards all or a part of the funding. This will likely give a small coverage if the marketplace falls or to the facet, on the identical time permitting to progressively transfer the bought, if the motion raises steam. The co -call of the deficient individual, as he’s ceaselessly referred to as, is a female friend of a dealer for methods for purchasing insiders.