Despite the fact that the previous can not ensure long term effects, it stays our maximum dependable useful resource for working out the marketplace habits. Up to nowI instructed how Monte -Carlo modeling can be utilized to guage those chances. However depending solely on one means limits. Diversification of the way we calculate the chances, provides the reliability of the research.

On this article, I will be able to deeply delve into 3 further strategies for calculating chances: Markov’s hidden items (HMM), the chances of seasonality and the alleged chances received from choices for choices. Every means has transparent benefits and enhances the Monte -Carlo method, offering a complete foundation for comparing credit score spreads.

1. Hidden Markov items (HMM): open the hidden dynamics of the marketplace

Markov’s hidden items (HMM) are a fancy system finding out methodology designed to research the information of time collection. They paintings within the assumption that the seen knowledge (as an example, the cost of a ticker) are generated by way of the primary set of “hidden states” that can not be without delay seen. Those states are quite a lot of marketplace prerequisites, akin to bull dispositions, undergo dispositions or sessions of low volatility.

How Hmm works

-

Resolution of observations and prerequisites:

- The seen knowledge on this context are historic costs for the closure of the ticker.

-

Hidden states are summary prerequisites that impact costs. For instance:

- State 1 (bull): Upper chances in value expansion.

- State 2 (undergo): Upper chances of motion at a descending value.

-

State 3 (impartial): Restricted motion for costs or consolidation.

-

Fashion coaching:

- HMM is finding out historic knowledge on costs with a purpose to learn about the chances of the transition between states and the likelihood of gazing particular value adjustments in every state.

-

For instance, the fashion can in finding out that the bull situation will more than likely transfer directly to a impartial state of 30% of the time and can stay a bull of 70% of instances.

-

Making forecasts:

- After coaching, HMM can evaluation the present state of the marketplace and use this data to expect long term costs.

-

He expects the chance that the ticker exceeds a definite threshold at this date, inspecting the possible transitions of the state and similar adjustments in costs.

Benefits of HMM in choices buying and selling

- Pattern reputation: HMM surpasses when figuring out nonlinear patterns in value actions, which can be ceaselessly lost sight of by way of more practical items.

- Dynamic research: In contrast to static items, HMM adapts to a transformation in marketplace prerequisites by way of turning at the state transitions.

- Likelihood evaluation: To distribute the mortgage, HMM supplies a probabilistic measure of whether or not the elemental stays above a brief blow in line with historic habits out there.

Figuring out the hidden dynamics, HMM gives a extra delicate view of marketplace chances, which makes it a precious device for assessing dangers and remuneration in loans.

2. Likelihood in line with the season: unlocking historic items

Seasonality refers back to the repeating items of costs for costs for such components as financial cycles, traders’ habits or exterior occasions. In business, likelihood choices in line with seasonality decide how ceaselessly the cost of a ticer exceeded a definite proportion of its present price right through a definite transient horizon.

How you can calculate the likelihood in line with seasonality

-

Resolve the edge:

-

The edge is expressed as a proportion in comparison with the present value (as an example, -2%, +0%, +2%). This normalization guarantees that the calculation of likelihood does no longer rely at the absolute degree of costs.

-

The edge is expressed as a proportion in comparison with the present value (as an example, -2%, +0%, +2%). This normalization guarantees that the calculation of likelihood does no longer rely at the absolute degree of costs.

-

Analyze historic knowledge:

- All over this era of habits (as an example, 30 days), calculate the share alternate in value for every historic remark.

-

Instance: If the present value is $ 100, and the edge is +2%, calculate how ceaselessly the cost exceeded $ 102 after 30 days in historic knowledge.

-

Accumulate effects:

- Divide the choice of occasions when the edge exceeded the full choice of observations to calculate likelihood.

-

Instance: If the cost exceeded the edge of 70 out of 100 copies, the likelihood is 70%.

Packages on credit score impose spreads

The possibilities in line with seasonality solution the query: “In similar conditions, how often did this ticker remain above the break -in?” This method is particularly helpful for ETF, which ceaselessly demonstrates extra predictable patterns than person stocks. For instance, some sectors can paintings higher at a particular time of the 12 months, offering an extra degree of working out.

Restrictions for attention

- The chances of the season are totally depending on historic knowledge and recommend that previous items will stay. Despite the fact that that is ceaselessly true for ETF, this can also be much less dependable for person stocks or right through sessions of marketplace violations.

3. The implied chances from value choices: extracting the temper of the marketplace

The costs for choices are better than simply numbers; They encapsulate collective ideals of marketplace individuals relating to long term costs. Inspecting the costs for the wags and calls on quite a lot of moves right through this date of expiration, we will be able to get the implied likelihood that the ticker is in positive value levels.

Steps for calculating the implied chances

-

Accumulate knowledge on parameters:

- Get costs for a chance at the wages and calls at other costs for moves on the desired date of expiration.

-

Calculate the implied volatility:

- Use the costs of choices to get the implied volatility (IV) for every blow. IV displays the expectancies of the marketplace one day volatility of costs.

-

Assess the likelihood:

- For every blow, calculate the likelihood that the ticker might be at a degree or upper, the use of IV and the Black-Scholes fashion (or equivalent strategies).

-

Then chances are aggregated to create the distribution of anticipated costs after expiration.

Why are the implied chances that issues

- Marketplace consensus: The implied chances replicate that the marketplace “thinks” in regards to the long term, providing the chance of ahead.

-

Dynamic changes: Against this to historic strategies, the implied chances are tailored in actual time to adjustments in marketplace moods, akin to information or macroeconomic knowledge.

Credit score software. Put the spreads

To distribute a mortgage, the implied likelihood can solution such questions as: “What is the likelihood that the ticker will remain above a short blow?” This working out is helping investors coordinate their methods with most important marketplace moods.

Conclusion

Integrating those 3 Markov-models, seasonal chances and implied likelihood of choices for my present Monte Carlo construction, I’ve advanced a competent gadget for comparing lending spreads. THis method lets in a complete research of the mortgage outdoor of cash (OTM), which places ahead a range a number of the villagesETFS, filtering for:

- Reinforcement/loss coefficients in positive thresholds,

- The expiration of the validity duration throughout the limits of a definite vary,

-

The minimal mortgage of 0.50 US bucks.

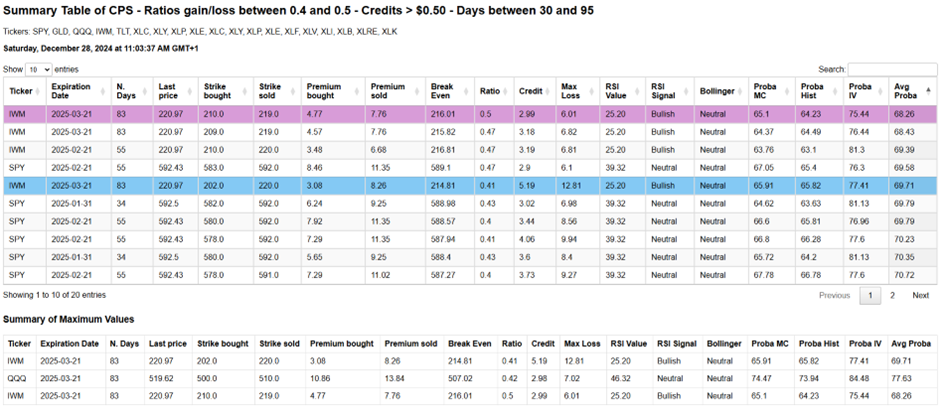

The result’s that I love to name the “star map” of the chosen spreads:

accompanied by way of a abstract desk:

Those equipment give readability and efficient concepts, serving to investors determine the most efficient transactions that provide the perfect likelihood of luck, maximizing attainable benefit in comparison to chance.

Having a look into the longer term, your next step will come with the calculation of the anticipated price ($ EV) of those transactions, a mix of chances and attainable effects for additional rationalization of the choice procedure.

Without equal objective stays the similar: to take away the possibilities in our choose – no longer by way of predicting correct costs, but additionally by way of comparing chances with accuracy and severity.

Apply the updates, as a result of I proceed to elucidate those strategies and increase their packages!