Choices can be utilized to hold out directed bets in the marketplace, for hedge of an extended or brief place within the elementary asset and make bets on adjustments within the implied volatility. Choices will also be used to obtain source of revenue.

One of the vital greatest choices is to cut back the chance of lengthy positions in promotions or different property.

Description of the protecting confus technique

The protecting level is a somewhat easy buying and selling or funding technique designed to check out to hedge the chance related to an extended place.

As an example, if a dealer or investor is an extended ABC stocks, then she or he can search for tactics to give protection to towards lowering stocks value.

The protecting Put technique merely contains the acquisition of an extended Put possibility, which is able to probably build up the fee if the cost of stocks decreases. Right here is a straightforward instance:

Protecting instance

Dealer Joe is positive at ABC stocks and owns 100 promotions at a mean acquire value of $ 40 consistent with proportion.

The corporate has a big source of revenue announcement in a couple of weeks, and Joe desires to hedge his possibility of lowering in stocks the use of protecting wagons.

For the reason that stocks are these days traded at $ 45 consistent with proportion, Joe makes a decision to buy a two -month possibility for $ 40 (this is, the cost of the strike is $ 42) consistent with bonus of $ 4.

Protecting instance

If the source of revenue announcement is regarded as positive, and the cost of stocks has risen, the PUT possibility may also be offered both again to the marketplace with a loss, or may also be withheld till the expiration of the validity duration.

If the cost of stocks is upper than the choice of the blow of $ 40 after expiration, then the choice merely expires is needless, and Joe comes out for $ 4 for the truth that it’s paid for the Put.

Then again, if the cost of the stocks fell sharply, then the Put Joe can probably get the fee and, most likely, compensate some and even all losses for stocks.

If the cost of stocks is less than the choice of a blow to $ 40 after expiration, then Joe has the correct to promote its stocks for $ 40, without reference to how low the stocks within the stocks.

As an example, if the cost of stocks has lowered to 35 US greenbacks consistent with proportion, Joe’s losses are restricted to an not obligatory bonus of $ 4.

When to put on it

Protecting Put is used to check out to melt the chance of lowering in an extended place and can be utilized in more than a few cases. Within the instance used above, the dealer sought after to check out to hedge the chance of a lower that may be acquired from a big source of revenue announcement.

In every other script, an extended -term investor can repeatedly purchase lengthy positions, which, in his opinion, can see a pointy build up in volatility. Lengthy issues also are lengthy vega.

In every other case, a dealer or investor should purchase a Put if the implied ranges of volatility are very low, which makes choices somewhat more cost effective.

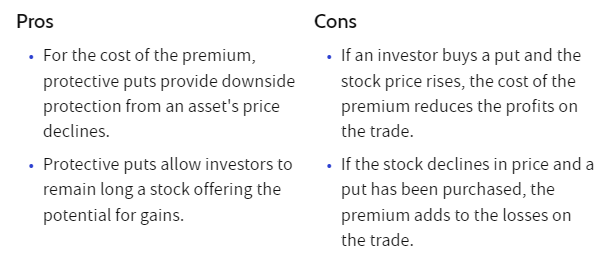

The pluses of technique

The principle purpose of the protecting Put is to hedge the chance of the shortcomings of an extended place within the elementary asset.

Choices may give a definite level of coverage for an extended place, which is able to additionally probably carry benefit if the stocks fall or if there’s a vital build up within the implied degree of volatility.

For the reason that Put possibility is got, the chance of PUT positions is restricted to the top class paid for this feature.

Cons of technique

The tactic could also be provided with some disadvantages. For the reason that parameters have the date of expiration, the choice will lose its price through the years when all different inputs stay consistent.

Choices which can be with reference to the present value of stocks will also be excessively dear, forcing a dealer or investor to shop for, which can be farther from cash.

Despite the fact that the bonds which can be farther from cash may give hedging from a big sale, the dealer or investor nonetheless go through a definite level for the promotion.

A merchandise this is a number of greenbacks from cash would possibly not get a enough price so as to be sure hedging from a minor to a reasonable relief in stocks.

Possibility control

Possibility control for protecting Put may also be accomplished in more than a few tactics.

If anyone has hedges an extended place, she or he will simply need to stay the choice till he expires, understanding that they’re going to lose all the paid top class.

Differently to control dangers may also be the sale of the standpoint in the marketplace if it loses a definite price. Some investors can, for instance, come to a decision to promote an finish to the marketplace if it loses part of its price.

Some other possibility control manner might come with apartment for a later date for expiration.

Imaginable changes

There are a number of tactics to arrange an extended place. A dealer or investor may to start with purchase issues this is farther from cash and throw it nearer to the cost of stocks as it’s drawing near and the choices turn into inexpensive.

Some other manner is also to show up for a very long time till a later date of validity, the use of the similar and even every other hit value. A dealer or investor will also come to a decision at the distribution of an extended possibility via promoting exhibitions towards him so as to cut back the root of prices.

The usage of some extent to give protection to an extended place at the base foundation is a somewhat easy place, however it comes with its personal set of dangers.

Traiders and traders should come to a decision what possibility they’re in a position to simply accept at the cost of stocks, and should additionally come to a decision that they’re in a position to pay for hedging.

Utilized in the proper cases, an extended duration may give a definite level of coverage for an extended place, however this possible coverage incorporates the fee.

Outcome

Protecting transports possible losses from stocks and does now not impact most make the most of promotion house owners. Then again, like different forms of insurance coverage, you should pay an advantage for the acquisition of protecting wagons. Ultimately, the acquisition of protecting wages may end up in a lower to your funding benefit.

Traiders and traders should come to a decision what possibility they’re in a position to simply accept at the cost of stocks, and should additionally come to a decision that they’re in a position to pay for hedging.

Utilized in the proper cases, an extended duration may give a definite level of coverage for an extended place, however this possible coverage incorporates the fee.

In regards to the writer: Chris Younger has a point of arithmetic and 18 years of economic enjoy. Chris British towards the backdrop, however labored in the US not too long ago in Australia. His passion within the choices used to be first led to via the “Trading Options” phase via the Monetary Occasions (from London). He made up our minds to put across this information to a much broader target audience and based Epsilon Choices in 2012.

Subscribe to strong now and enjoy the entire energy of choices promoting to hand. Click on the button beneath to begin!

Sign up for Steadyopts now!

:max_bytes(150000):strip_icc():format(webp)/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png?w=1536&resize=1536,0&ssl=1)