Bell choices

Name choices are the appropriate to shop for a promotion at a predetermined worth sooner or later.

They’ve a number of key purposes and phrases:

On the middle

All choices are derivatives – i.e. They get from fundamental safety.

On this case, the fundamental safety it will likely be a proportion – Apple (Aapl), say, or an index, akin to S&P 500 (see under in additional element).

Thus, the decision possibility provides the holder the appropriate, however now not the duty to shop for fundamental sooner than the choice.

Strike (or workout) worth

That is the cost that the bottom may also be bought.

So, as an example, if the AAPL name has a blow to 200, then the holder can buy AAPL stocks at this worth at any time sooner than the choice.

Very best sooner than date

The date through which the decision possibility expires is i.e. The fitting to shop for stocks lasts most effective till this date.

Top rate choices

The price of purchasing choices.

Thus, as an example, a three -month possibility for calling AAPL 200 (this is, the landlord can purchase 100 AAPL stocks at any time over the following 3 months) can value $ 15 in line with proportion (this is, 1,500 US bucks) in an possibility top class.

Name possibility P&L Diagram

Position the choices

The bonds are reverse to calls that they offer the landlord the appropriate, however now not the duty to promote stocks at a predetermined worth someplace sooner or later.

They’ve equivalent purposes for calls:

On the middle

The protection by which the landlord of the choice has the appropriate to promote.

The cost of the strike

The fee at which the bottom may also be offered sooner or later.

Very best sooner than date

The period of the time all over which the holder should use (or use) the choice sooner than the expiration of its validity.

Possibility Prize

The price of purchasing an possibility.

Position the choice P&L diagram

Please word that the PUT holder does now not want to personal promotions sooner than purchasing a Put.

The landlord can merely promote this feature within the open marketplace in a while sooner than the expiration of the validity length whether it is in cash (see under).

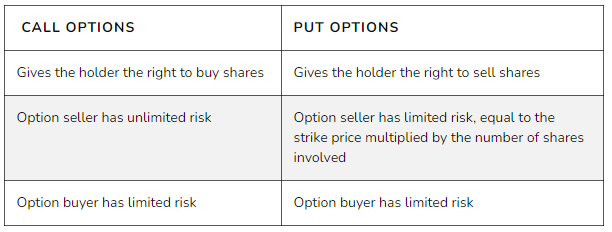

Name and position choices: variations

Crucial distinction between the choices for calls and the choices for lining is the appropriate that they offer the landlord of the contract.

Whilst you purchase a choice possibility, you purchase the appropriate to shop for stocks in The cost of the strike Described within the contract. You hope that the cost of the promotion will build up above the cost of the blow. If this occurs, you’ll be able to purchase stocks at the cost of the blow, which is not up to the present marketplace worth, and in an instant promote them to make a benefit.

Whilst you purchase Position the choiceYou purchase the appropriate to promote stocks at the cost of the strike set forth within the contract. You hope to scale back the cost of the bottom promotion. If the cost of stocks falls under the cost of the affect, you’ll be able to promote stocks at a better worth than what those stocks available in the market are traded and make a benefit.

Name and position choices: different stipulations and issues

Writing choices

Till now, we targeted at the purchaser.

Then again, probably the most sights (and risks) of choices buying and selling is that you’ll be able to even be at the different aspect of business, because the so -called “writer” of the contract for choices.

The writer of the choice receives the preliminary possibility for the introduction of the choice. Thus, as an example, $ 1,500 within the AAPL instance might be paid to the authority of choices (or dealer, as they’re often referred to as).

One essential idea that must be understood is that the P&L of the choice for its writer is the P&L of the P&L Purchaser.

V/V/OF Cash

They are saying that possibility:

In cash, if at the moment the cost of the blow is not up to the cost (calls) within the present base (calls) or upper (calls)

Of the cash, if at the moment the cost of the blow is upper than the cost (calls) or decrease (demanding situations).

-

On cash If the cost of the affect and the present worth are the similar (each for calls and for issues)

Mini calls and places

Usually, one contract with choices refers to 100 stocks within the fundamental ones.

Thus, as an example, one AAPL name possibility lets you acquire 100 AAPL stocks.

Then again, in 2017, CBOE introduced the so -called Mini Choices for 5 extremely traded fundamental securities: Amazon (Amzn), Apple (Aapl), Google (Goog), Gold ETF (GLD) and S&P 500 SPRD (Undercover agent)

Those choices, designed for small retail traders, observe most effective to ten stocks.

It’s nonetheless unknown whether or not this new product might be simply as well-liked that it’ll be: the preliminary reception was once gradual.

Position Name Parity

The important thing theoretical thought, which the extra complex choices buyers will have to be understood, is about through Name Parity.

Since that is an advent to the choices, we will be able to now not move into main points on this, however, in the end, that is the concept that reasons and the demanding situations aren’t as heterogeneous as you suppose.

In truth, you’ll be able to construct an possibility of Put or name through purchasing or promoting a Put, calls and reserves. Thus, as an example, the choice of the offered Put is equal to the bought proportion and the sale offered.

And because they’re the similar if the cost of the decision, you’ll be able to deduce the cost of the Put (and vice versa).

Due to this fact, the decision and supply of costs are attached – the attached name, hanging the decision parity. We’ve a extra detailed clarification right here: position Name Parity defined.

Consequence

Choices will have to now not be obscure whilst you perceive their fundamental ideas. Choices can give alternatives with right kind use and may also be damaging whilst you use it.

In regards to the writer: Chris Younger has a point of arithmetic and 18 years of economic enjoy. Chris British towards the backdrop, however labored in america lately in Australia. His passion within the choices was once first led to through the “Trading Options” phase through the Monetary Occasions (from London). He determined to put across this information to a much wider target audience and based Epsilon Choices in 2012.

Subscribe to solid now and enjoy all of the energy of choices promoting handy. Click on the button under to start out!

Sign up for Steadyopts now!