Bitcoin is experiencing a solid descending development, even if it helps a much wider macro gallur. Even if lengthy -term forecasts stay certain, brief -term weak point means that BTC can proceed to stand gross sales force.

Traders’ conduct didn’t supply a lot strengthen, which contributed to additional uncertainty available in the market.

Bitcoin wishes traders strengthen

Within the closing days, the most obvious requirement of Bitcoin has sharply diminished in contemporary days, and in contemporary days, call for has sharply diminished. This relief marks probably the most important lower since July 2024 and the primary position in 4 months. The autumn signifies the expansion of skepticism amongst traders, which results in a lower in hobby for the acquisition and building up of brief -term endure force.

Decreasing call for means that marketplace members don’t dare to succeed in new positions. If call for does now not recuperate within the close to long term, Bitcoin can battle to handle its present costs, which is able to building up the danger of additional distances.

Bitcoin visual call for. Supply: Cryptoquant

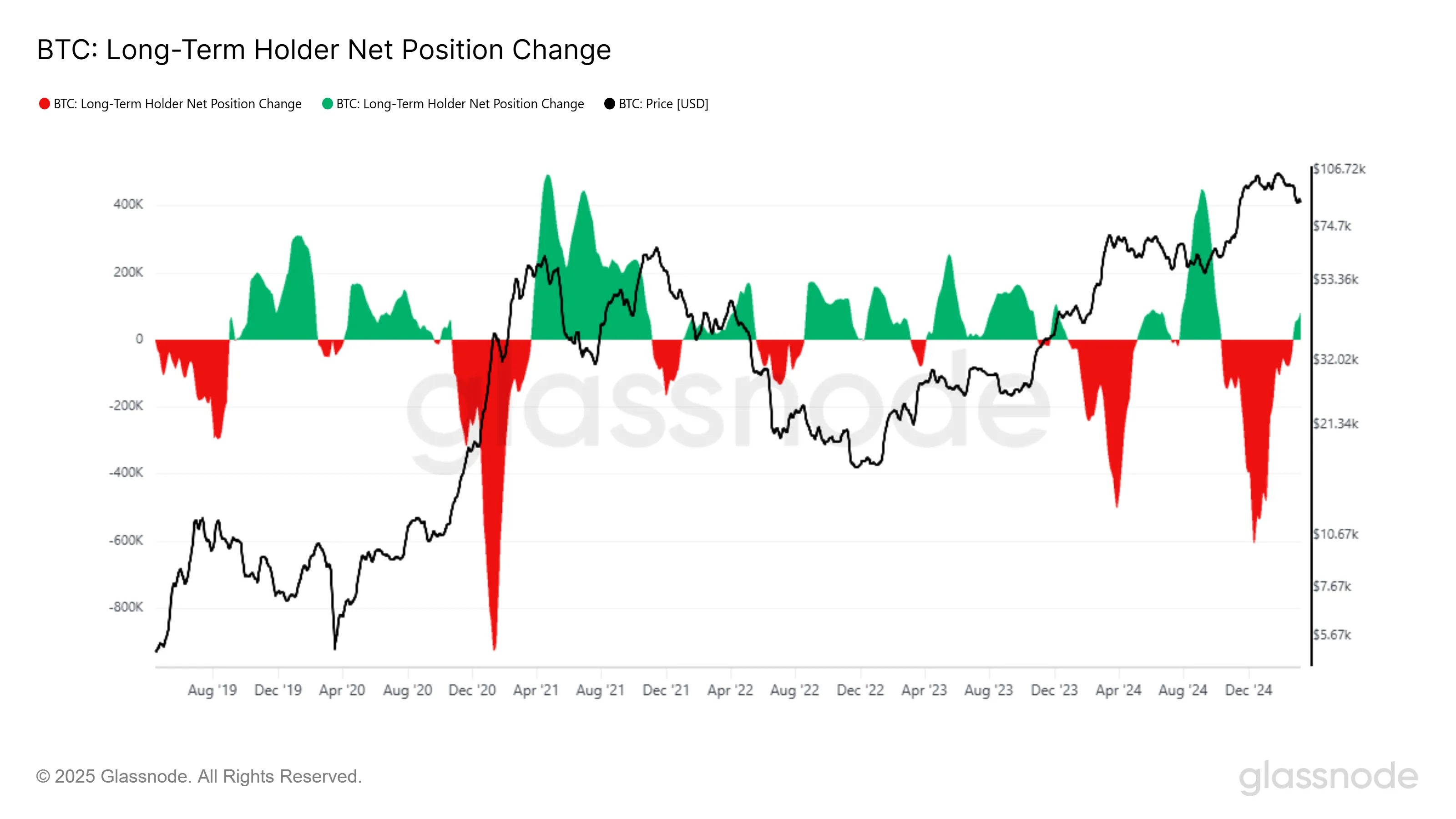

Lengthy -term holders (LP) shifted against resale of accumulation, as proven within the metric of adjustments within the natural place of LTH. During the last 30 days, those traders have collected greater than 107,413 BTC. Traditionally, the buildup of LTH indicators lengthy -term self belief, however within the brief time period it steadily precedes the classes of worth weaknesses.

LTH, most of the time, accumulates at decrease costs and start to distribute right through the run. This template assumes that Bitcoin can nonetheless stumble upon a way prior to an important restoration starts. Even if lengthy -term accumulation is certain, an extra brief -term volatility and attainable worth correction could also be an instantaneous affect.

Bitcoin LTH NET LOGE. Supply: Glassnode

Bitcoin LTH NET LOGE. Supply: Glassnode

BTC worth can fall additional

The cost of Bitcoin, recently on the stage of 82,305 bucks, is transferring in a stretching downward wedge. Even if this template is traditionally positive within the macrosclad, within the brief time period this means a better chance of continuous the shortage. BTC would possibly want to test decrease strengthen ranges prior to confirming the exchange.

Given the marketplace stipulations, the fast -term worth forecast is that Bitcoin would possibly lose a decisive strengthen stage of $ 80,000 and fall to test $ 76,741. If wider macroeconomic components go to pot, the lower can unfold additional, doubtlessly attaining as much as 72,000 bucks. This sort of state of affairs will supply an extra bearish at the crypto -market.

Bitcoin costs research. Supply: TradingView

Bitcoin costs research. Supply: TradingView

Alternatively, a shift within the temper of traders can exchange this trajectory. If the buildup will increase with mental strengthen of $ 80,000, Bitcoin can repair a bull impulse. The transition to 82,761 US bucks would have laid the trail for BTC to surpass $ 85,000, in the end attaining $ 87,041. Such construction will deprive the deprivation of a second within the box of endure possibilities and sign.