Solana (SOL) is preventing under US greenbacks from March 3, and its technical signs nonetheless point out a endure development. The choice of Solan Whales has declined in contemporary days, assuming that some huge holders can scale back the publicity.

In the meantime, the full value of SOLANA (TVL) stays under $ 10 billion, emphasizing the weakening of interplay in its Defi ecosystem. To ensure that SOL to revive the bull impulse, he’ll want an up to date accumulation of whales, restoration in TVL and a leap forward above the important thing resistance ranges.

SOLANA TVL caught under $ 10 billion from February 22

The overall price of SOLANA, blocked (TVL), is often diminished. These days, it’s $ 8.87 billion, and the closing time it exceeded 10 billion US greenbacks on February 22.

TVL represents the full quantity of property deposited within the protocols of decentralized finance of the blockchain (Defi), serving as a key indicator of community job and self assurance of buyers.

The next TVL comes to sturdy interplay with the ecosystem, whilst a discount in TVL might point out a discount in liquidity and extinction of hobby.

SOLANA TVL. Supply: Defillama.

Since Solana’s TVL continues to fall, it reasons worry in regards to the possible weakening of call for for its Defi ecosystem, which will have an effect on the cost of salt, at the present time when the community and a few of its major avid gamers are criticized by way of the neighborhood.

Lowering TVL incessantly displays a decrease influx of capital and relief in job within the protocols of lending, formation and business, restricting the rise in value impulse.

To toughen SOLANA to toughen, its TVL will wish to be stabilized and restored, signaling the resumption of buyers’ agree with and lengthening the community software.

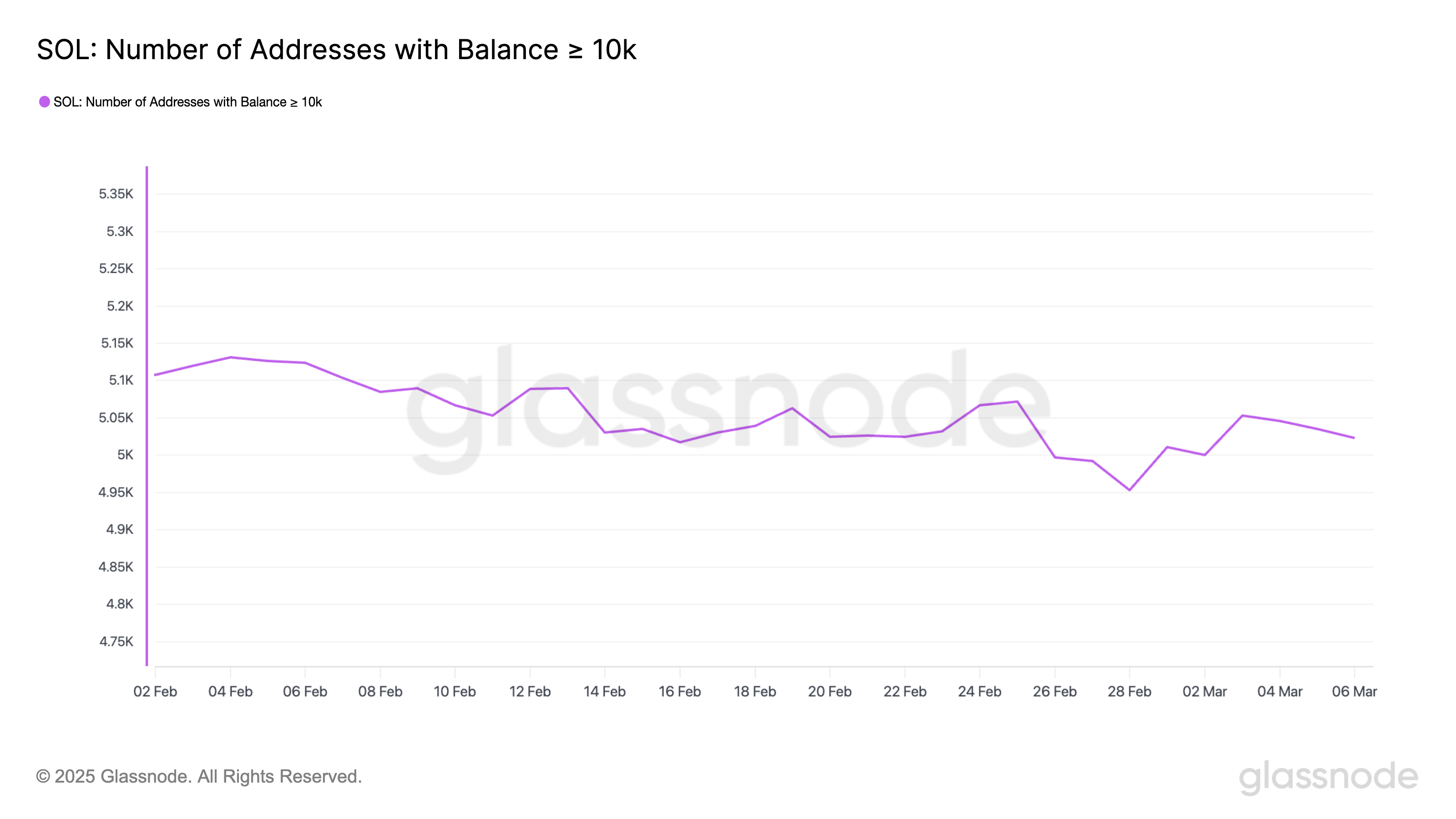

Whales stopped gathering Sol

The choice of SOLAN WHALES – addresses that include a minimum of 10,000 SOL – has grown within the length from February 28 to March 3, expanding from 4953 to 5053. Alternatively, since then the quantity has been often diminished, now it’s been sitting at 5023.

The tracking of the job of the whale is an important as a result of huge holders can have an effect on marketplace tendencies. Accumulation incessantly alerts self assurance in value elevating, and distribution incessantly signifies the possible force of gross sales.

A gentle building up within the choice of whales generally signifies prime call for, whilst a lower can trace on the weakening of moods.

Solan whales. Supply: Glassnode.

Solan whales. Supply: Glassnode.

With a contemporary fall in Solana Whale, there are issues that some huge holders can scale back the publicity, which will create force on SOL.

If this development continues, it may restrict their power and result in value consolidation or a lower.

Alternatively, if the whales of the resume are resumed, this may occasionally point out a renewable self assurance within the lengthy -term possibilities of Solan, doubtlessly supporting a more potent relief in costs.

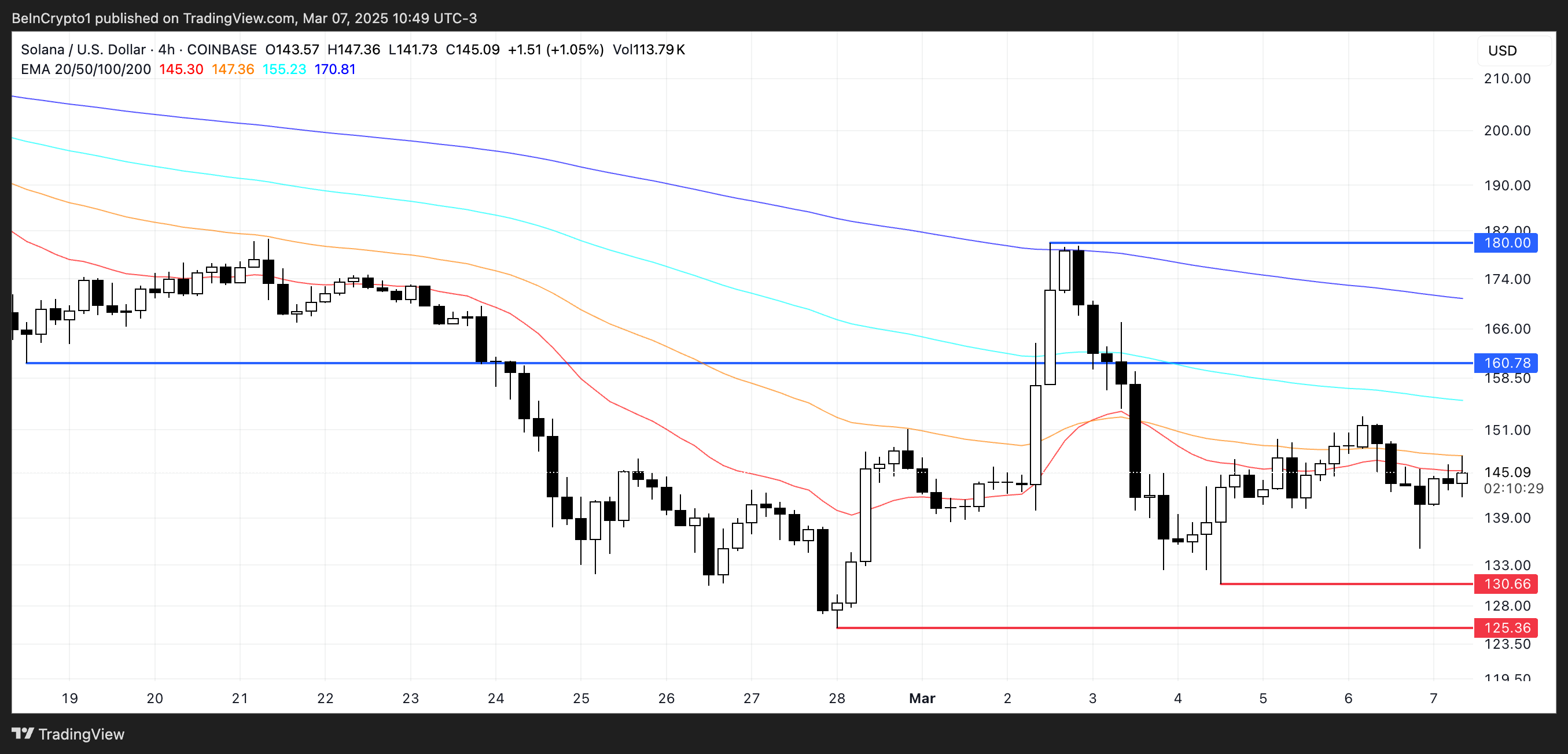

Solan remains to be suffering to violate $ 150

The EMA Solana strains display that the present set up stays a endure, with brief -term reasonable, nonetheless situated under the lengthy -term.

This alignment means that the force down is preserved, restricting the quick expansion possible.

SOL value research. Supply: TradingView.

SOL value research. Supply: TradingView.

Alternatively, if the craze adjustments and buys an impulse, Sol can upward push to $ 160.7, and a leap forward above this degree can push it to test the resistance of $ 180.

Alternatively, if endure impulses accentuate, Solana Worth can re -test strengthen of $ 130.

Breaking under this degree can scale back the fee, doubtlessly checking $ 125.