Solana (SOL) confronted in depth gross sales drive, not too long ago reducing under $ 120 – its lowest degree since February 2024. Over the last 30 days, it has reduced by way of greater than 38%, strengthening its bearish impulse.

Since dealers are firmly underneath keep watch over, SOL is now confronted with a essential take a look at of toughen ranges, whilst any possible restoration will wish to wreck in the course of the resistance zones with a view to sign the heart beat shift.

SOLANA ICHIMOKU CLOUD displays a powerful endure set up

SOLANA ICHIMOKU CLOUD displays that the fee is lately traded under each the blue Tenkan-Sen (conversion line) and the Purple Kijun-Sen (fundamental line), which signifies that the temporary pattern stays a endure.

The fee has not too long ago bounced from the native minimal, however has now not but restored those key resistance ranges. As well as, the approaching ICHIMOKU (Kumo) cloud, reflecting endure moods out there.

The cloud itself is situated considerably upper than the present worth, assuming that even supposing SOL is experiencing temporary restoration, it is going to most probably come upon sturdy resistance close to the area of 130-135 bucks.

SOL ICHIMOKU CLOUD. Supply: TradingView.

Tenkan-Sen positioning under Kijun-Sen moreover helps endure possibilities, since this crossover in most cases alerts the heart beat.

For any indicators of fixing the fashion, SOL will have to have damaged over either one of those strains and preferably input the cloud, which signifies a possible transition to a impartial section.

Till then, the endure’s cloud is forward and the present vulnerable worth construction means that any rallies can also be brief ahead of a much wider descending pattern resumes.

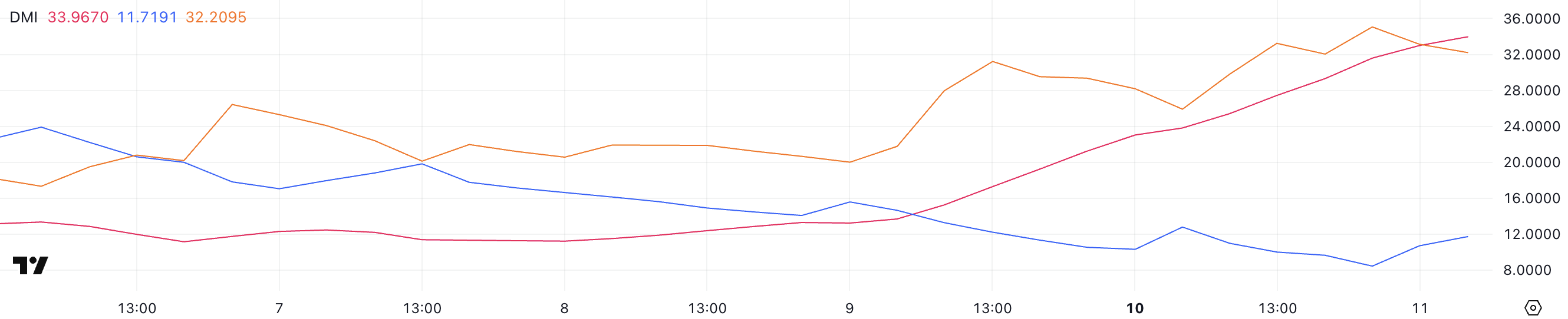

Sol DMI displays that dealers are nonetheless underneath keep watch over

The diagram of the required SOLANA (DMI) motion displays that its reasonable course (ADX) index is lately 33.96, which has higher considerably in comparison to 13.2 handiest two days in the past.

ADX measures the power of the fashion, and the symptoms above 25 in most cases point out a powerful tendency, whilst values under 20 counsel a vulnerable or non -existent pattern. Given this sharp build up, this confirms that the ongoing descending pattern of salt is gaining power.

+DI (sure course index) fell to 11.71 from 15.5 two days in the past, however the day prior to this fairly bounced from 8.43. To the contrary, -DI (unfavorable course indicator) is at 32.2, when put next with 25.9 two days in the past, even if it reduced fairly from 35 hours in the past.

Sol DMI. Supply: TradingView.

Sol DMI. Supply: TradingView.

The relative positioning of the strains +di and -di means that the dealers are nonetheless underneath keep watch over, since -DI stays a lot upper than +DI.

A up to date fall in -DI from 35 to 32.2 might point out some brief -term aid, however with a snappy ascent of ADX, this complements that the important descending pattern stays untouched.

A small rebound of +di comes to a slight drive at the acquire, however this isn’t sufficient to switch the impulse in want of the bulls. Thus far, +di is not going to upward push above -di or ADX, it is going to now not start to decline, endure pattern will most probably stay, and dealers dominate the fee motion within the close to long term.

Solan will fall under $ 110?

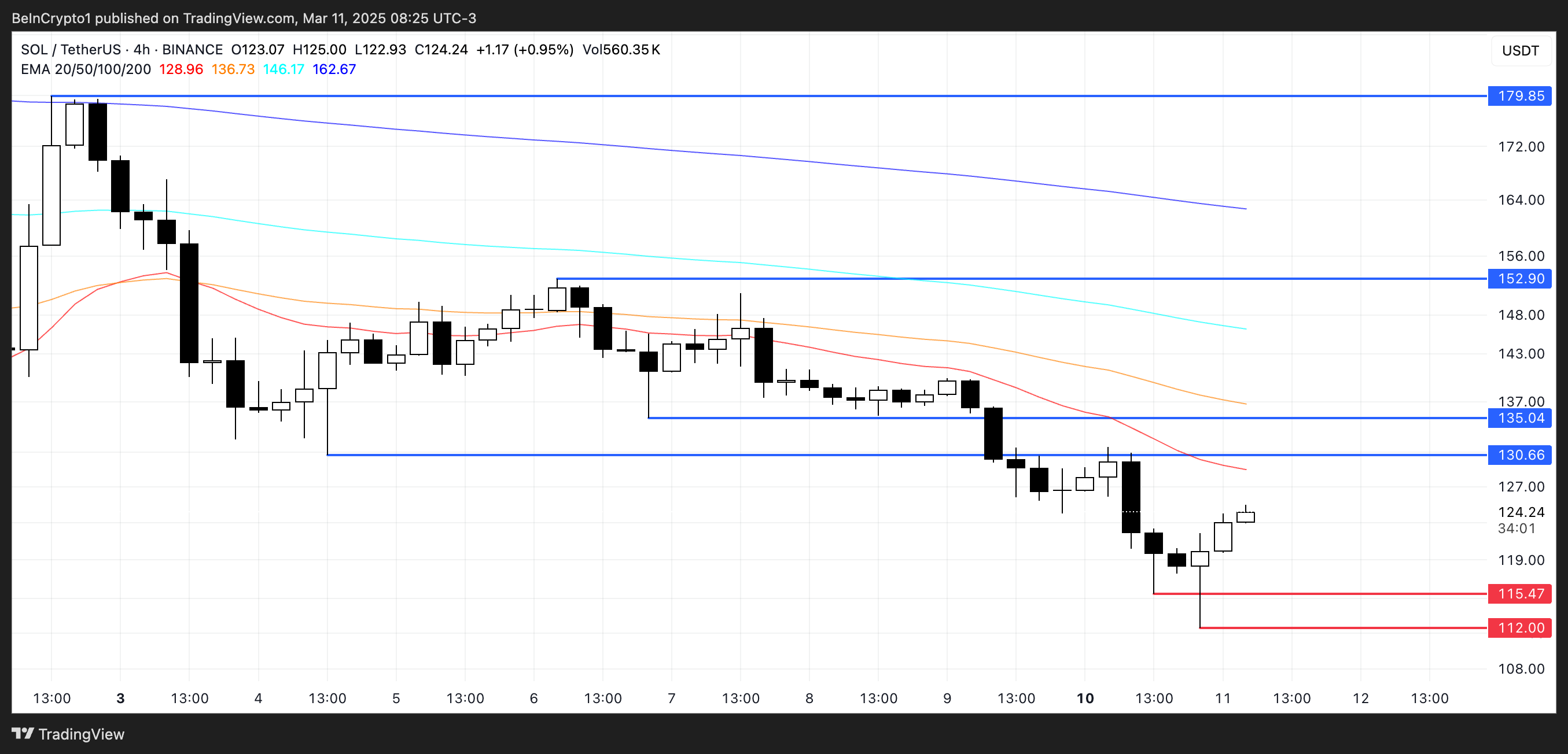

The strains of the exponential sliding medium saline (EMA) proceed to depict a endure tendency, and the fast -term EMA are situated under the lengthy -term EMA.

This leveling means that the descending impulse stays dominant, even supposing the fee is lately attempting restoration. If this rebound positive aspects power, the cost of Solan might come upon a resistance of $ 130 and 135, key ranges that are meant to be cleared for any possible alternate within the tendency.

A a success wreck above those resistances can push Sol to $ 152.9, an important degree, which, whether it is violated by way of sturdy drive drive, may just pave the way in which for a pleasant to $ 179.85 – the fee degree for the remaining time, when on March 2, when Sol was once added to the crypto -strategic reserve of america.

SOL worth research. Supply: TradingView.

SOL worth research. Supply: TradingView.

Then again, if the endure construction stays untouched, and the drive on sale is resumed, Solan can re -check toughen ranges of $ 115 and 112, either one of which up to now acted as key costs.

The lack to stay those helps can open the door for a deeper recession, most likely pushing Sol under $ 110 for the primary time since February 2024.

Given the present positioning of EMAS, the descending pattern stays underneath keep watch over if SOLANA does now not repair the important thing ranges of resistance and does now not set the bull crossover, signaling the shift of marketplace sentiments.