On this article I will be able to provide Monte -Carlo modeling, provide an explanation for their relevance V Business and describe the precise means of the choices industry that I’ve advanced the usage of those modeling. I will be able to additionally percentage the rear debt effects for example the effectiveness of the tactic.

1. What’s Monte -Carlo modeling?

Monte -Carlo modeling is a computing approach used to style the chance of quite a lot of ends up in a qualified provider that can not be simply predicted from the presence of random values. Named after the well-known on line casino, those modeling are particularly helpful in finance, as a result of they will let you analyze uncertainty and chance.

The method contains the release of hundreds And even tens of millions of simulations in line with ancient value actions, the place each and every simulation tasks a conceivable long term consequence. The ensuing distribution supplies investors with the chance of value levels throughout this time.

2. How are Monte -Carlo simulations utilized in industry?

In industry, Monte -Carlo Type Type is helping to foresee As a monetary device, comparable to ETF, comparable to Undercover agent or QQQ, can behave throughout the long run length. The method appears round a number of years of ancient knowledge on costs and passes a lot of simulations to expect long term value distributions. Exits typically display the distribution of chances of long term costs, highlighting key metrics, comparable to trusting durations. Here’s an instance for a secret agent:

Those simulations are beneficial for choices for choices, since they provide an concept of the chance that the motion or ETF will stay throughout the above/cheaper price for a definite time period. This data is helping to create structured choice methods, comparable to Credit score Plos Spreads, which benefit, when the asset stays upper than the associated fee threshold.

3. An instance for a mortgage.

Right here, for instance, the results of 10,000 simulations carried out on SPY to expect motion in 15 days, asking the set of rules to calculate which share of knowledge above the edge of $ 565. For instance, if we imagine that this price is a improve or that this price can be a spoil in even the tactic of a variety that we’d put into effect.

We see that there’s a chance of 77%, that the ticker is above this threshold price.

Recall that Monte Carlo’s modeling observes the previous habits of Tiker for a few years, everyday, shows statistical distribution and plays random footage orientated, like a statistical distribution to seize the pseudo-stupor nature of the marketplace. It’ll be vital to peer how those forecasts have come true up to now.

Please be aware that in an effort to take note the ancient distribution of Tiker, we wish to alter the Monte -Carlo modeling manner within the code. As an alternative of assuming a standard distribution through value actions, I style adjustments in costs in line with the true ancient distribution of source of revenue. This method, ceaselessly referred to as the preliminary load, is ancient go back samples immediately as an alternative of producing artificial returns in line with a hard and fast customary distribution.

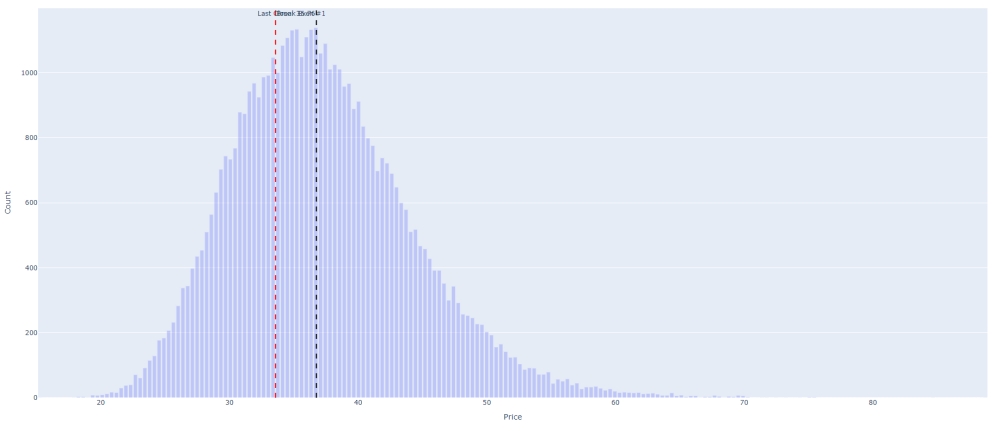

That is then the kind of plot that we get :

4. Technique: The usage of Monte -Carlo modeling for choices buying and selling

Using the rupture of the cultivation of the iron condor as threshold values isn’t fascinating, for the reason that modeling confirmed that the loans gained within the name of the decision weren’t sufficient.

So, let’s focal point on portions PUT thru Credit score Pul Proples. For this ETF (we will be able to go away stocks from the source of revenue), there are lots of shelf existence and lots of shocks, each and every at its personal value. Which ETF to make a choice, what blow to shop for and sale and which one dates?

To do that, this system that I wrote scanned crucial ETF (“spy”, “GLD”, “QQq”, “IWM”, “EEM”), all their expiration between two numbers (min_Days = 30 max_Days = 120) and all of the assaults under the OTM strike that may shape a mortgage. Thus, the purpose is decided, for instance, (SPY, 2024-11-15, PUT bought = 577 US greenbacks, Plaase = 582 US greenbacks).

For each and every level, the code then plays 10,000 Monte -Carlo modeling, having a look again at twenty years and the calculation of the chance that the Undercover agent Clos can be upper than the distance even in 29 days (= the selection of days closing between the prevailing and the expiration date). Then, this system shows all issues within the type of a graph with abscesses, allegedly estimated and at the receipt, the chance of Monte -Carlo. Credit score> 0.50 US greenbacks and a benefit/loss issue above 40% are decided on simplest.

The agenda is split into 4 quadrants, which is essentially the most fascinating for us of the northeastern quadrant (most credit score and most chance). Then this system detects two issues, which on this quadrant have the best chance or the best mortgage.

Here’s an instance of the show:

4. The result of the behind the curtain

To substantiate this technique, we carried out a backing check the usage of ancient knowledge during the last 15 years. The speculation used to be to simulate what would occur if this technique used to be implemented up to now, and the spoil even corresponds to the chance calculated on the decided on level.

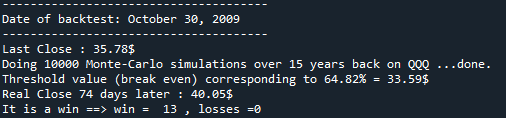

To be able to use the instance right here above with the utmost mortgage, this query will solution this query: for the QQQ ticker within the expiration date of 2024-12-31 (in response to 74 days, the date of writing of this text), the simulations of Monte Carlo tell me that the closure of QQQ has the chance of 64.82% of the tactic spoil. If I used this technique for 15 years up to now, everyday with a spoil even at the moment comparable to this quantile, is the actual price of QQQ would actually be upper than this hole? And if this is the case, how again and again it labored between 15 years in the past and now, everyday?

To be extra particular, throughout the again check, the set of rules very obviously shows the result of step by step backsters:

An instance of a screenshot throughout a backing check:

and the histogram agenda to turn out the coordination of the edge price:

This systematic manner with correct chance control supplies investors with a formidable device for making cheap choices at the construction of choices. It’s value noting that the efficiency of each and every technique can range relying on marketplace prerequisites, so the constant backing checking out is the important thing to keeping up a positive technique in creating markets.

The general results of the backing check for this technique is:

Which means that the backing exams give the most productive effects (83.64% of the win) than the chances declared through the Monte Carlo modeling (64.82%), and industry will also be open.

Conclusion

Monte Carlo modeling provides medical and regulated knowledge, able to projecting long term costs within the ceaselessly unpredictable international of industry. The usage of those modeling, we will be able to expand methods aimed toward acquiring price through correct predicting costs of costs in sure brief horizons. Western exams display that the usage of this technique, particularly for methods for lengthy -term choices, comparable to iron condors, can considerably build up the chance of luck.

This manner enhances different methods of choices and offers a competent foundation for structuring transactions with a prime chance of benefit, whilst totally controlling the danger.