Crypto-financial markets enjoy a sense of deja vu, as analysts examine present macroeconomic potentialities with previous cycles, particularly earlier Trump’s industry wars.

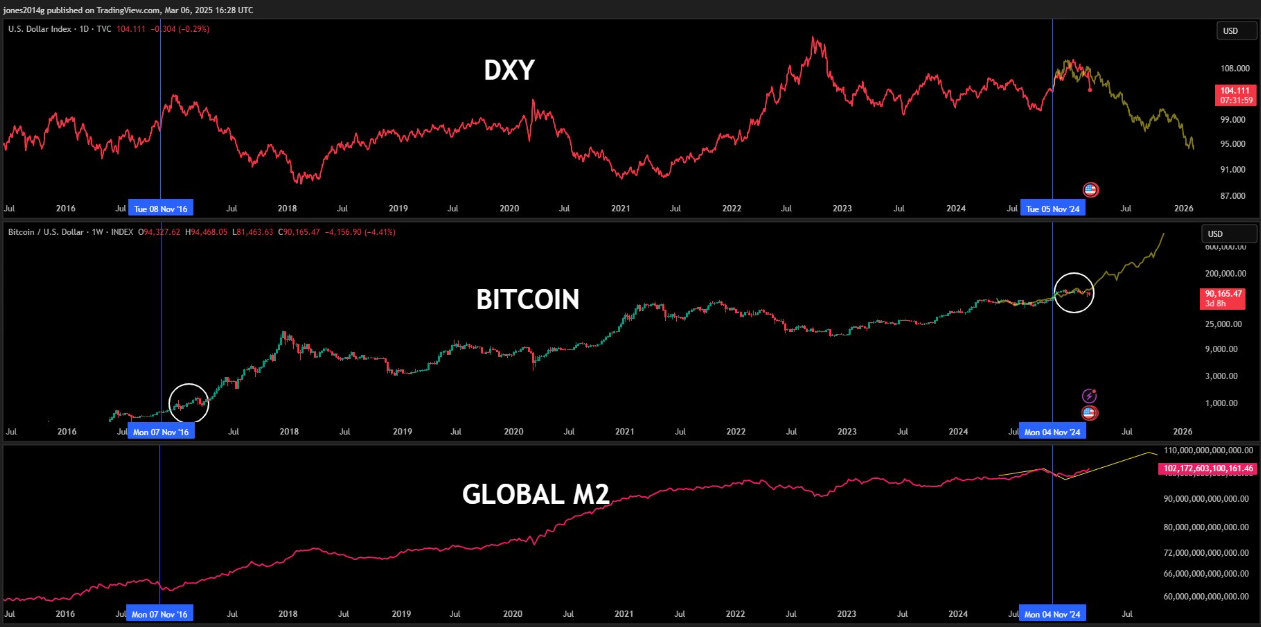

Since buyers and respiring buyers be expecting to revive the crypto marketplace, all eyes stay tied to the USA buck (DXY) and cash provide M2 for conceivable pointers.

Bitcoin, Altcoins and price lists: Forward is a rally within the 2017 taste?

The hot agenda from Zerohedge emphasizes how the USA buck index (DXY) in 2025 in moderation displays its 2016 actions. This offers self assurance in the concept that the echo marketplace traits repeat previous fashions.

2016 in opposition to 2025 DXY HART. Supply: Zerohedge on X

This parallel attracted vital consideration of buyers, particularly within the crypto sector. Analysts assessment whether or not Bitcoin (BTC) and Altcoins would be the next trajectory in their bull cycle of 2017.

Observation within the economic marketplace, a letter from Kobiassi, weighed this dialogue, emphasizing the similarity between the Trump Trump tariff 1.0 and a pair of.0.

Trump battle tariff 1.0 (2019) in opposition to 2.0 (2025). Supply: letter Kobeissi on X

Trump battle tariff 1.0 (2019) in opposition to 2.0 (2025). Supply: letter Kobeissi on X

Remark admits that lately’s macroeconomic prerequisites are other from the former Trump management. However, it additionally notes that a number of technical actions in step with the categories of property, together with stocks, gold, oil and bitcoins, had been amazingly identical.

Till now, greater than 10p.chave larger gold costs, which displays the shift against more secure property. In the meantime, Bitcoin reduced by means of nearly 10%. This divergence emphasizes the significance of possibility urge for food within the formation of marketplace moods.

This implies that the actions managed by means of liquidity and technical resistance ranges play a dominant function in worth fluctuations. On this regard, the letter from Kobeissi famous that lengthy -term buyers who took benefit of the volatility all the way through Trump Buying and selling Conflict 1.0 discovered nice alternatives. This implies that such prerequisites would possibly rise up once more.

Altcoin season to compare the Trump season

In the meantime, the rising narrative within the crypto -space is that the “Altcoin season” would possibly correspond to the “season of Trump”. Crypto -investor and analyst Bitcoindata21 emphasised how Bitcoin’s worth motion in 2025 resembles a 2017 cycle. This remark strengthens the realization that at the horizon there is usually a huge altcoin rally.

DXY in opposition to Bitcoin in opposition to International M2 in 2017 in opposition to 2025. Supply: Analyst on X

DXY in opposition to Bitcoin in opposition to International M2 in 2017 in opposition to 2025. Supply: Analyst on X

Historic traits recommend that the strengthening marketplace of bitcoins steadily precedes explosive enlargement in altcoins when the capital rotates. This will increase the possibility that the approaching Bully cycle can mirror Altcoin -Bum, what was once noticed all the way through the primary time period of Trump.

In some other position, wider financial traits additionally point out doable enlargement for bitcoins. In step with Beincrypto, DXY lately fell under the toughen degree that will traditionally be an positive sign for bitcoins. The weakening buck has a tendency to push buyers to choice property, reminiscent of cryptocurrencies and gold.

As well as, analysts have recognized the increasing cash provide M2 as some other issue that may gas the bitcoins rally. Traditionally, the extensions within the M2 coincided with the principle bitcoin labels, and mavens are expecting the surge in overdue March because the liquidity prerequisites make stronger.

Nowadays, uncertainty stays top from macroeconomic elements and political shifts. However, historical past means that buyers strategically place themselves in volatile classes and steadily obtain vital rewards.

If the template is repeated from 2017-2020, bitcoins and altcoins can input the up to date bull cycle within the coming months. However, buyers must stay vigilant, since brief -term volatility stays a key feature of the present marketplace setting.