Believe that you’re engaged in trade and set up a promotion, the place you be offering folks 3 greenbacks for each and every 1 buck that they spend. Oh, and there are completely no prerequisites who can declare this proposal. Your grandmother, a homeless dude at some point, a neatly -paid chief or an bizarre center -class particular person have the proper to this proposal.

What do you assume will occur? Smartly, individuals who want cash essentially the most, and they may be able to be the least repeated consumers in mass crowds to habits you on cleansing till you’ve gotten cash or reserves to deal with this be offering.

The above situation is strictly what Arbitrum did roughly, excluding $ 85 million and in the end won a lack of $ 60 million within the procedure. Let’s dig into the truth that it was once the scheme, the way it was once structured, and that we will extract from this.

Arbitrum Dao structured this on this manner when sure verticals and their corresponding programs will obtain ARB tokens to stimulate their platform. In the end, the theory is that, stimulating the usage of those platforms, Arbitrum will obtain extra charges as a community, and the general protocols will even win. It seems that one birthday party received right here, and the opposite is much less (I’m positive that who the loser is right here).

The research is somewhat top with sophistication across the measurements and offers the main points of the locking command for a transparent dimension, why, what and the way round their way.

You’ll learn/discover the effects your self right here: https://discussion board.arbitrum.basis/t/ardc-ReSearch-deliverables/23438/9

At a top point, you’ll be able to divide this marketing campaign into two top -level parts:

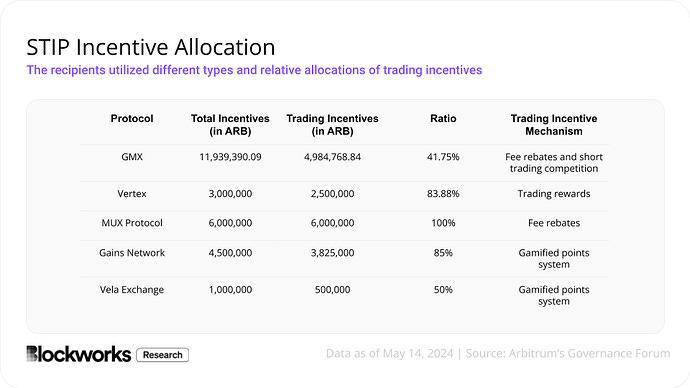

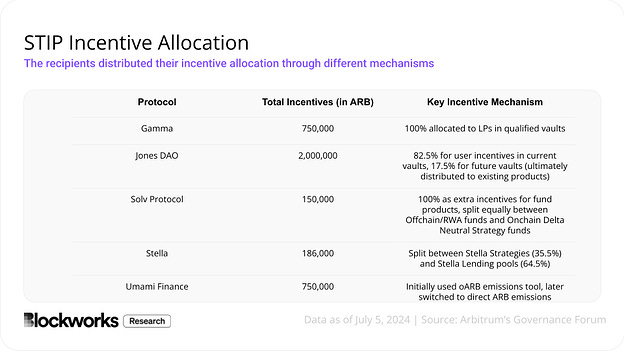

To scouse borrow finish customers of programs in several verticals in step with arbitrators, offering them with arb tokens for juice their metrics. 3 verticals had been decided on (perps, dexs, liquidity aggregators). Every utility was once given how absolute best to spend the motivation.

I discovered some fascinating excerpts that I assumed, I grew to become on right here in your personal judgment:

“Many protocols missed several two -week reports or did not publish them at all. About 35% of all STIP recipients did not publish the final report. ”

“It was once now not continuously that the protocols had been strictly justified, why they must allocate a definite collection of incentives when making use of for of venture. Somewhat, the general appropriations, more often than not, had been the results of the opposite and the phase between the protocols and the group, which continuously resulted in a distribution in keeping with one thing corresponding to “we feel that this issue is too big/small.”

Finally, I transfer on. I grew to become on screenshots for more than a few classes, what number of had been spent, and the mechanism (with out a display screen technique for DEX, however principally they just stimulated liquidity). The important thing factor to keep in mind is that 1 ARB is kind of than $ 1. So sure, it’s disbursed hundreds of thousands of bucks.

I wish to smash the effects into two portions right here, as a result of there are two issues that this experiment is geared toward working out.

The affect of those incentives on programs

The affect of those incentives for the source of revenue of the sequences

We’re going to get started our research with the primary, as it attracts a relatively happier tale. Smartly, if we expect from the primary ideas, if any person will give you unfastened cash to regulate promotions for your online business, what do you assume will occur? Smartly, more often than not, the trade will reinforce – for some time. That is what we noticed in all spaces with this experiment.

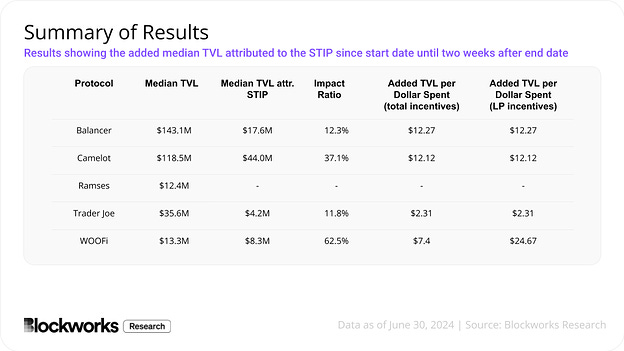

Ranging from Dexs, their effects appear somewhat respectable at the floor:

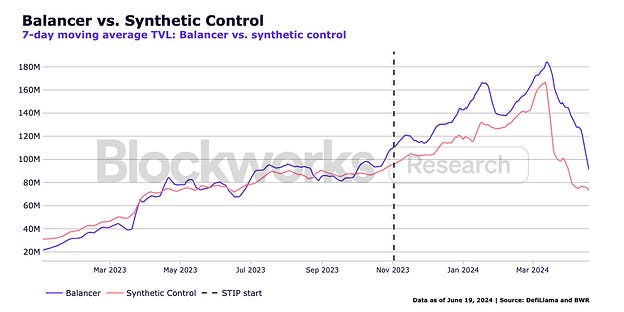

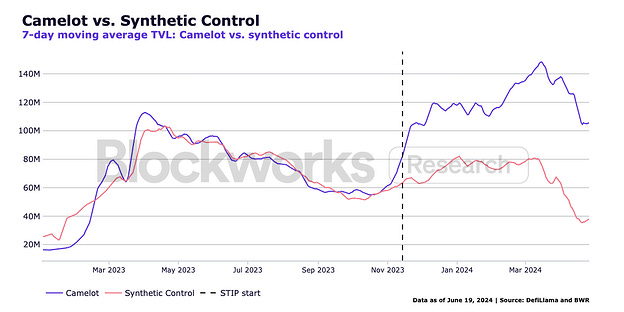

Thus, we principally see that TVL was once earned from 2 to 24 greenbacks for each and every buck spent, which sounds just right. However, we want to ask an actual query right here – what number of of this was once preserved? That is the place it turns into a bit of sophisticated. The TVL Balancer principally fell after the awards ended, as clearly thru this diagram:

However, Camelot, however, was once in fact controlled to avoid wasting this TVL! I’m now not positive why those two protocols had been other from their retention, but when I needed to think that this may be some way that they introduced their stimulation program and sorts of customers that they attracted for the marketing campaign itself. That is what I added to the bookmarks and analyze myself in a long term article.

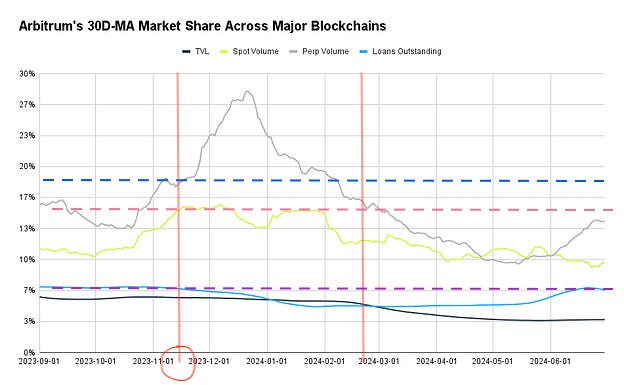

Now that you recognize one of the vital microorganisms, assist you to build up and know how efficient it’s for programs and 3 top-cathegors that topic (quantity Spot Colume, Perp and loans). I provide to you our key diagram. I needed to announce on height of this to assist this perceive all this, so stick with me, as I provide an explanation for it.

I drew two pink vertical strains to notice the start of this system and the tip of this system. This will likely assist us perceive the phrases with which we’re dealing right here.

Then I drew a number of horizontal strains to know more than a few metrics and visualize how this system influenced those metrics all through his existence.

The primary blue line principally presentations that TVL flashed strongly (now not unusually), however then most commonly fell to beneath, the place this system first started to suggest virtually none of them was once sticky!

The second one line is level volumes. I wish to pause right here and point out that, in contrast to the TVL, which is a facet of the be offering and prices not anything, the purpose quantity is a requirement. As we see, the call for was once consistent at absolute best, however by the point this system was once over!

The 3rd line is exceptional loans, that are additionally a requirement motive force and don’t have any adjustments. Whilst lending protocols weren’t stimulated, I to find him some other robust metric of call for. It in fact fell right through this system!

So what are we able to do from the entire above? Smartly, principally Arbitrum spent $ 85 million on a majority of these different enterprises in order that the juice in their metrics from the proposal (which obviously labored), however become needless, since there was once no corresponding requirement to soak up this TVL and extra dense liquidity. In reality, you should say that every one this cash was once lit within the fireplace and transferred to employed farmers. No less than sure protocols have a better TVL and a better value of token, which makes some folks richer within the procedure 😇

Talking concerning the facet signs of call for, after all, all this job was once just right for the chain and led to raised source of revenue from a majority of these transactions – proper?!

Smartly, now not in point of fact.

In reality, no, by no means.

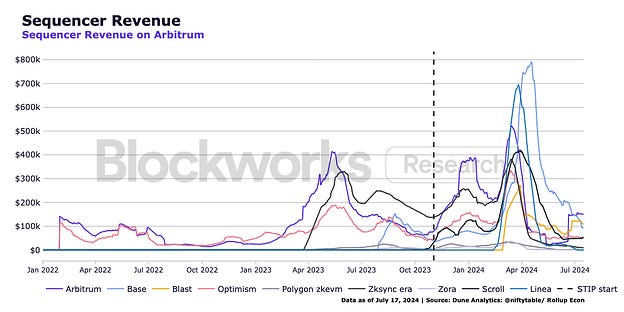

So, this is the sequences’s source of revenue diagram from January 2022 to July 2024. A big surge round April is when Crypto started to develop, and artificial keep watch over is helping us to give an explanation for this.

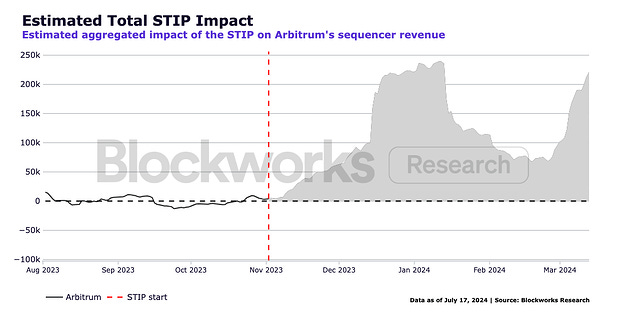

To start with look, we see that the income has grown, achieving 400 thousand greenbacks in keeping with day for sure months. Here’s a clearer desk that presentations the affect just for the referee and bearing in mind artificial keep watch over:

So what space is below the curve? $ 15.2 million should you take away artificial keep watch over, you’ll obtain a complete of 35.1 million greenbacks. The US is general. We’re nonetheless a ways from God right here, this $ 85 million was once spent!

Summage the entire above:

Arbitrum determined to spend $ 85 million on stimulating the community actions to extend advertising and source of revenue

They did this, offering unfastened tokens to programs/protocols that distribute them to their ultimate customers

After the research, a majority of these unfastened tokens had been transferred to drivers from the events, and nearly no adjustments had been proven with regards to call for

Having a look even deeper, the source of revenue from the sequences from all this job was once 60 million greenbacks not up to the volume spent

What’s my elimination? The primary is the stimuli for supplying are as just right as combustion of cash, and also you must now not do should you should not have an issue from the proposal (typically now not, the call for is a requirement).

The second one that may be a prerequisite round what I touched in the beginning of the item was once: should you give cash to Randos, now not noticing who they’re and the place they got here from, you’ll get what you pay for is to explain, 💩. Protocols that proceed to offload cash to customers, now not working out who they’re, what their intentions finish, in addition to the trade described in the beginning of this text.

Allow us to believe that this stimulation scheme distinguishes who those tokens got during the persona with out the permission of the pockets and had standards corresponding to:

In reality, does this consumer use DEXS or is it a fully new pockets?

What’s the community of this pockets and is that they a doubtlessly precious acquire for acquire?

How a lot did this pockets spend on charges? Do they adhere to the platforms that they use?

Does this deal with lately use all issues that experience upcoming tokens? They most definitely scent of a farmer.

What do you assume the general end result will likely be?

I consider that the paintings that the group and I do in 0xarc will remedy those issues. We nonetheless have a number of key parts for developing, but when you have an interest find out extra about to not be shy.