Maximum of February, the Krypto marketplace, the marketplace, overcame the marketplace sideways, however this week the task fell from the affect of the army offers of Donald Trump. Over the last 24 hours, the decline within the remaining 24 hours is a decline in additional than 800 million bucks, as traders fought with volatility.

Regardless of the rollback, some cash endured to acquire crypto, positioning themselves for attainable achievements in March. This research considers a few of these property.

Bitcoin (BTC)

The BTC has damaged underneath the important thing fortify line this week, which has retained its worth within the vary from the start of February, and fell to many months. The main marketplace coin is now buying and selling at $ 79,610, that the associated fee that used to be registered in November.

BTC Whales used their cut price costs to reinforce their property, which is mirrored on account of a surge within the community of huge holders of the coin. In keeping with IntoTheblock, the metric has grown by means of 23% during the last seven days.

BTC massive Netflow holders. Supply: Intotheblock

Massive holders are the addresses of whales that include greater than 0.1% of the circulating asset provide. Their Netflow screens the adaptation between the inflow and the outflow of the asset held by means of those primary buyers.

When it rises like this, this means that enormous holders acquire extra an asset, which comes to greater self assurance and attainable building up in worth power. This development too can inspire the BTC retail traders to extend the power at the acquire.

If this continues, this may increasingly cut back the be offering of the coin in stream and building up its price in March, in all probability even upper than $ 95,000.

Sandbox (sand)

Metaverse token Sand additionally aroused up to date pastime from whales this week, because the marketplace expects a much broader restoration in March. Token is traded at 0.29 US bucks all through printing, noting a lower by means of 43% during the last month.

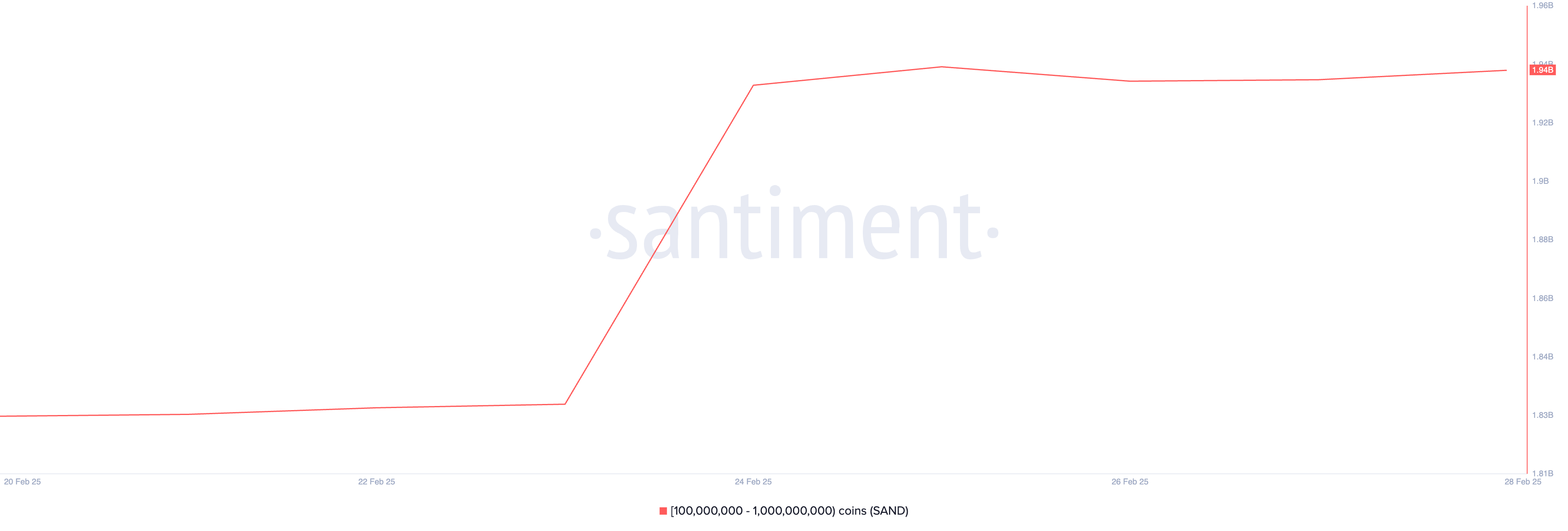

In keeping with Santiment, over the past week, Whales, proudly owning 100 million tokens, collected 180 million sands value greater than $ 52 million at present marketplace costs. All the way through the click, this cohort of buyers has 1.93 billion sands, which is the best calculation since June 2024.

Sand provide distribution. Supply: Santiment

Sand provide distribution. Supply: Santiment

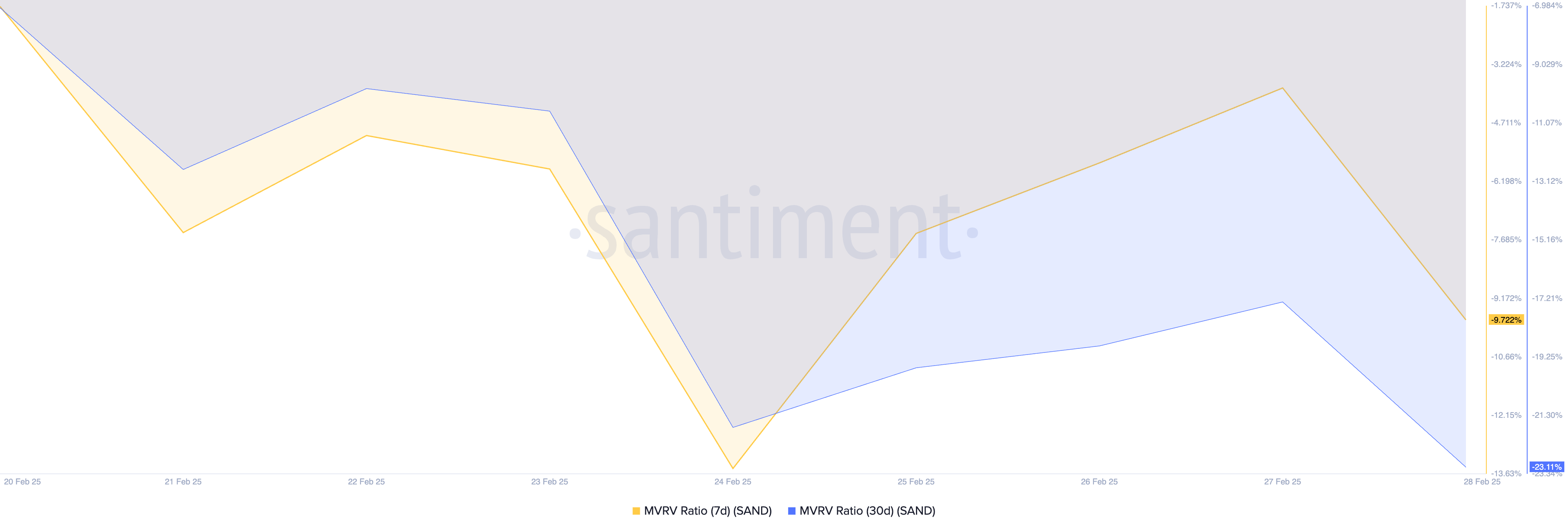

A pop -up affect in Sand Whale Holdings is because of its present underestimated standing, which is mirrored within the indications from its marketplace price to the learned price (MVRV). On the time of writing, Article 7 -days and 30 days of MVRV altcoin are -9.72 and -23.11, respectively.

Sandless ratio of MVRV. Supply: Santiment

Sandless ratio of MVRV. Supply: Santiment

Traditionally unfavourable MVRV coefficients are a purchase order sign. They point out that property are traded underneath its historic acquire price, offering the opportunity of purchases for buyers who need to purchase a fall.

Due to this fact, if this whale accumulation continues, it could actually push the cost of the sand of $ 0.35 in March.

Optimism (OP)

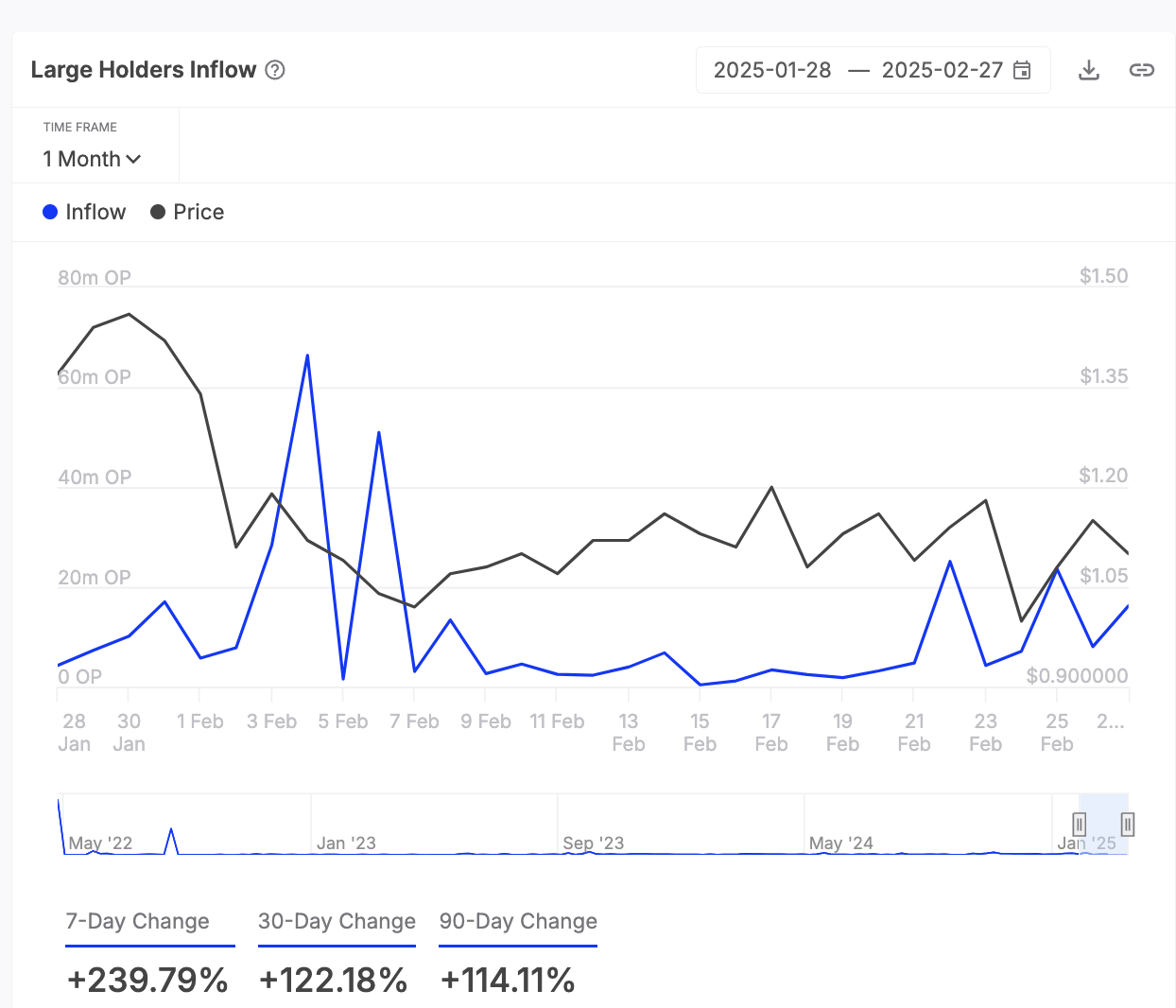

Token Op Layer-2 (L2) is some other asset that whales are strategically received to reach in March. Intoleblock knowledge published 240% of the surge of the inflow of its massive holders during the last seven days.

OP is a big holder. Supply: Intotheblock

OP is a big holder. Supply: Intotheblock

All the way through this era, the price of OP has fallen by means of 8%, which signifies that its whales greater the inflow, in spite of the aid in costs.

When massive holders building up their inflow, they switch vital quantities of asset to their wallets. That is most often thought to be as a bull sign, since this means self assurance someday of the associated fee motion of the asset and the potential of the ascending impulse.

If this continues till March, it could actually summarize the cost of OP to $ 1.52.